2011 Survey of Affluence and Wealth in America Holiday Forecast - Gift-Giving Emphasis On Quality and Experiences

The Survey of Affluence and Wealth in America, produced by YouGov Definitive Insights and American Express Publishing, shows that America’s affluent consumers will find holiday joy by focusing on relationships and experiences, rather than material gifts. The survey sampled 769 affluent Americans with discretionary household incomes ranging from $100K to over one million dollars.

Affluent households – who represent the top 10% of American wage-earning households – are expected to account for 23% of the total 2011 holiday spend ($68.74 billion) this season. Gift-giving budgets of affluent families are down, resulting in an overall decline of $1.04 billion (a 6.1% drop) in gift-giving intentions among affluent and wealthy families, compared to 2010. This decline is led by those with discretionary incomes of $100K to $250K, whose holiday spending budgets are projected to be 17% lower than in 2010. On the other hand, expenditure on gifts will be up 7% (to an average of $2,708) among those at the very top of the income spectrum, with discretionary incomes of $250K or more.

Seven percent of all the affluent families surveyed report that they are increasing their spending this year by an average of 33% for a 2011 gift-giving budget of $3,887. Conversely, the 14% of those surveyed that plan to spend less expect to spend an average of $884 this year. For added context, the study also polled 839 consumers in a general population sample. Non-affluent consumers that were surveyed plan to spend an average of $558 on gifts this holiday season, with 28% of the general population expecting to spend less on gifts than they did in 2010.

The declines among the affluent population are not the result of increased anxiety over personal financial situations. Twenty-nine percent of affluent consumers report that their household income is up over last year and 30% say the same about their assets. Eighty-four percent say they are confident that they have the financial resources to weather a continuation of the recession or a double-dip recession. One in five affluent consumers say they are happier now than they were a year ago, and 76% testify that they are a “lucky person.”

After four plus years of reprioritizing and realigning their spending to match their values, affluent consumers are feeling quite good about themselves and their ability to maintain – and even increase – their family’s happiness and well-being.

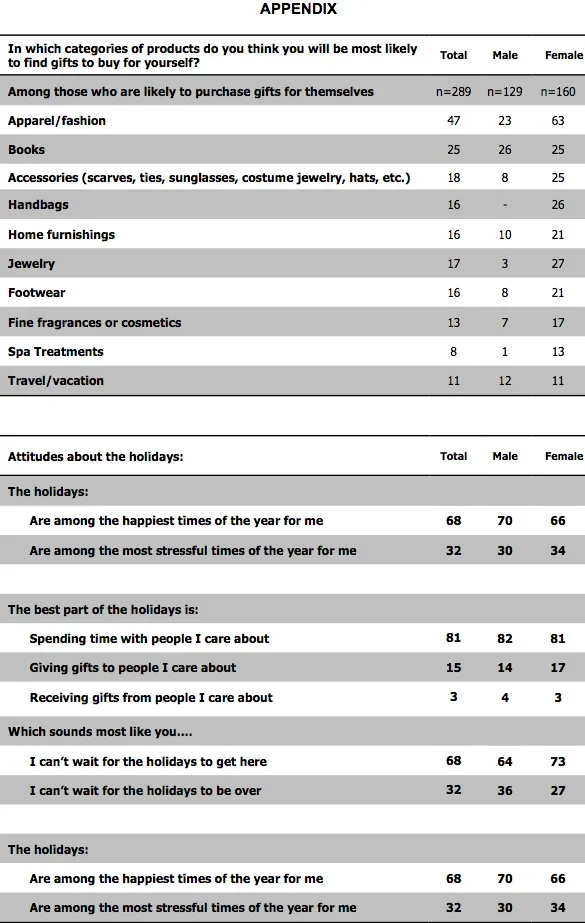

In fact, 84% of affluent Americans indicate that they are determined to make this holiday season a great one for their family. Eighty-one percent say that the best part of the holidays is spending time with the people they care about, versus either giving (15%) or receiving gifts (3%). Expressions of happiness are being increasingly decoupled from the desire to acquire more and more things. The search for the holiday spirit no longer centers on the search for ‘stuff’ – it resides in family and in simplicity.

Fifty-seven percent of affluent consumers say they are looking to buy fewer gifts this holiday season. Among the 14% who say they are trimming their gift budgets, 57% say this is because they “just don’t need as much stuff.” This response is up 14 points from last year. In 2010, the number one response to this question was “worried about the economy” and, interestingly, this answer is down 21 points in 2011, from 68% to 47%.

For the majority of affluent consumers (69%) the gifts they buy need to have “lasting, enduring value.” It would seem that, at least for some, experiences fit the bill. One in three are planning to take a special trip this holiday season as a gift for their family, one in five would like the gift of travel as a gift for themselves and 13% would like a gift certificate to a restaurant. Furthermore, 28% of all affluent consumers are looking to “splurge on a special holiday gift” for their family – a rate that rises to 40% among the wealthiest consumers, with discretionary incomes of $250K or more.

A significant percentage of affluent consumers, 31% of men and 49% of women, say it is very or extremely likely that they will purchase for themselves as they are buying for others. This may be because husbands and wives are not likely to see their “wish list” fulfilled by their spouses. Thirty-six percent of wives would like jewelry as a holiday gift while only 27% of husbands plan on giving gifts in this category. Twenty-two percent of married women would like a spa treatment, while only 11% of married men plan on giving this gift, and 25% of wives want a gift card to a specific retailer with only 12% of husbands saying they will purchase this for their wives. But the biggest disconnect is in the most common gift that wives plan on giving their husbands: 47% of wives say they will buy apparel for their husbands, but only 21% of husbands have put this on their wish list!

Additional Findings:

- One in five affluent Americans plan to spend more time with their immediate family, 16% will spend more time with their grown children, parents or grandparents and 16% will spend more time with friends.

- Small parties will trump larger celebrations, with 10% planning to spend more time hosting intimate gatherings at their home.

- Sixty-eight percent of affluent consumers say the holidays are “among the happiest times of the year” while 32% say they are among the most stressful.

- Men and women have similar views on gift-giving:

- Forty percent of all respondents say that if they could, they would give only gift cards, gift certificates or cash,

- Thirty-four percent say they would make charitable donations in lieu of gifts, and

- Twenty-seven percent would skip gift-giving all together, given the opportunity.

- When it comes to the mix of on- and off-line shopping, 37% of affluent consumers say they will do more of their gift shopping online than in stores, while 24% say there will be a pretty even split. Only 34% of those surveyed say they will do more shopping in stores rather than online.

- Online shopping wins hands-down on convenience and price, with 71% of affluent consumers saying that online is more convenient and 53% that believe you find better prices online.

About The Survey of Affluence and Wealth in America

The data reported above was part of a re-contact study from the 2011 Survey of Affluence and Wealth in America. For this study, YouGov Definitive Insights conducted follow-up interviews with 769 respondents from the initial wave of the Survey of Affluence and Wealth in America in Q1 2011.

The 20 minute survey fielded from September 18 to 26, features participants with a minimum discretionary income of $100,000. Income groups represented and analyzed in the study include Upper Middle Class ($100K - $150K household discretionary income), Affluent ($150K - $249K), Super Affluent ($250K - $499K) and Wealthy ($500K+). The study was complemented by a parallel survey among the 839 consumers who represent the general population. Of these 839, 747 represent the 90% of the population considered “non affluent” and whose discretionary income in under $100,000. Both studies are nationally projectable, with a sampling error of +/- 5% among the total samples.

(*) Tables for publication must contain the following reference in publication: Source: The Survey of Affluence and Wealth in America, produced by American Express Publishing and YouGov Definitive Insights: September 2011 Results