Q1 Findings of 2011 Annual Survey of Affluence and Wealth in America

In 2011, affluent consumers are more confident in the economy. Consequently, retailers will see a partial return to pre-Recession spending levels. Consumers will make more big-ticket item purchases and will increase their category spending. However, consumers have not forgotten the hard-learned lessons of the Great Recession. They will continue to pride themselves on being resourceful, making need-based purchases influenced by close family and friends. They will also focus on how purchases will affect their own health and well-being and how purchases will benefit them in the immediate future.

Now in its sixth consecutive year, the 2011 Survey of Affluence and Wealth in America, is produced by American Express Publishing and YouGov Definitive Insights. The survey was conducted in early February 2011, examining 1376 households that represent the top 10% of the American income spectrum.

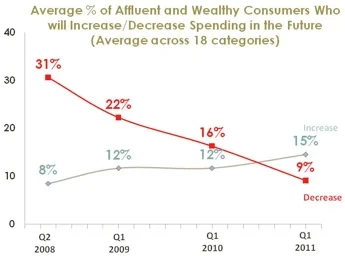

The percentage of households planning on increasing their spending is up 25% over 2008, with over 45% of America’s wealthiest families (defined as having at least $500,000 in discretionary income) planning to increase luxury outlays. Within the luxury categories alone, researchers estimate spending will increase by $28 billion, or nearly 8%.

"It is a relief to finally be able to see a significant return of affluent consumers to the luxury marketplace – fashion, travel, services and home décor," said Dr. Jim Taylor, YouGov Definitive Insights, in summarizing the good news for luxury marketers, producers and retailers.

"We will see a similar increase in automobiles as consumers begin to act on delayed purchasing, look at home décor and home repair, replace automobiles and even return to high-end resort real estate and capital markets. However, the return of consumers does not mean an abandonment of the resourceful, needs-based purchasing model that has been the hard-won benefit of four or five years of recession. Luxury consumers will seek out extraordinary quality, service and craftsmanship, but they will do so with an expectation of securing price advantages in their negotiations with merchants. The affluent consumer remains needs-based, resourceful and research oriented. They will exercise discretion."

Present-Tense Reality

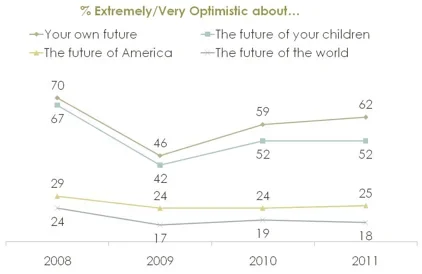

Today’s affluent and wealthy consumers see few, if any, rewards in basing their decisions on future scenarios and contexts that are, at best, beyond their control and at worst, wildly unpredictable. In short, these consumers view the future one-day-at-a-time and live in a "present-tense reality." Specifically, in 2010, optimism in one’s own future and the future of one’s children recovered only about 50% from the drop seen from 2008 to 2009. Now, in 2011, faith in the future has essentially stalled. As a result, the country’s richest citizens are making purchasing decisions in part based on what benefits they can reap in the here and now.

Even so, today’s affluent and wealthy consumers are more confident in the economy and the job market than they have been. While 79% still believe we are in a recession, this percentage represents a steady downward trend from the high of 98% in 2009. There was a 14-point rise over the course of the year among those affluent and wealthy Americans who believe the job market is improving (58% now do); and a large dip in those who felt their own jobs and the companies they work for are in jeopardy. Fewer, too, worry that their careers will stall or that they will not have the skillset to compete in the job market. This has contributed to an overall easing of economic anxiety and an associated, significant decrease in the percent saying that they are buying fewer big-ticket items.

In Q1 2009, 77% of affluent consumers agreed that they planned to purchase fewer big-ticket items than the previous year. In Q1 2010, this number dropped to 64%. Now, in Q1 2011, the number has fallen even lower, to only 47%.

The Radius of Personalization

Affluent and wealthy consumers are following a decision-making model that places valued relationships, specifically family and close friends, at its core. From there, the radius of personalization extends outward into a very specific set of priorities including physical and financial health, category needs and finally, to issues of style and image. Accordingly, two-thirds of luxury consumers say their primary passion is their family. In fact, 65% percent of respondents consider themselves to be family-focused and 66% claim to be happily married.

It follows, then, that America’s affluent and wealthy are more invested in their children’s opinions in 2011 than in years past. These families are now relying more heavily on their progeny’s input to make decisions – from planning fun activities (78%) and vacations (66%) to purchases in other significant categories. These include high-end tech products (up 11 points since 2008), automobiles (up 7 points) and major household purchases like appliances and furniture (up 11 points).

Beyond the family unit, 69% of the affluent and wealthy say their friends’ opinions are highly valued when making purchasing decisions. Furthermore, 61% want to be healthier and cite this desire as their primary goal for 2011. Spending decisions are thus partially influenced by recommendations from friends and by whether the product in question can be connected to overall health and well-being, including financial health. Seventy-seven percent of affluent consumers say that it is increasingly important to be financially self-sufficient; and 71% have taken steps to educate their offspring about finances.

Equally important in 2011 is whether the product in question is connected to their purchasing intentions. Retailers in 2011 will see increased interest in replacing obsolete automobiles, upgrading home décor, family travel and even children’s fashions. In fact, 64% of families are increasing their category participation spending in at least one category, and one out of two are increasing it in three or more categories. However, even as they begin to purchase again, these consumers are still of the mindset that a purchase must be connected to real needs and provide them with a strong sense of value.

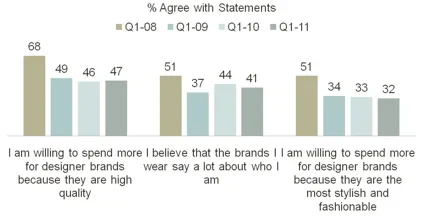

The final tier in the radius of personalization is how purchases will affect buyers’ individual sense of style and appearance. Since the beginning of the Great Recession, brands have come to be less regarded as symbols of quality, representations of self or epitomes of style – and the same holds true today. Affluent and wealthy consumers are less willing to pay more for name brand items than they were in 2008; in essence, resourcefulness has acquired the cachet and mystique the brands themselves may have lost.

Creating Magic Moments

As luxury brand consumers in the U.S. focus their purchasing decisions on present-tense reality and the radius of personalization, it will become even more important for retailers to create "magic moments." Consumers are savvy. With increased access to the Internet, they do their research, compare prices and determine what they want to buy long before they set foot in a store. As a result, they look to salespeople to bring greater knowledge and insight to the table than the customer themselves can find on their own via a quick Google search. Before the start of the Recession, seven out of ten of the wealthy and affluent depended largely upon a salesperson to demonstrate the value of a luxury brand. Today, that number is just over half. Even fewer, 26%, depend on a close relationship with a specific salesperson. Only 2% of these consumers consider salespeople to be a trusted source of information.

The difference at point-of-sale is now focused on how well a salesperson can articulate details of distinction, relate their products to the customer’s passions and infiltrate the consumer’s network – ideally through social media. The bounce-back of luxury spending has been largely facilitated by the instant feedback retailers have been able to garner from social media networks and maintaining an online presence. This is especially true in light of the fact that the majority of affluent and wealthy consumers own a Smartphone or tablet technology (51% and 15%, respectively).

Survey Methodology

The Survey of Affluence and Wealth in America, produced by American Express Publishing Corporation and Harrison Group, details the lives and lifestyles of Americans with at least $100,000 in annual discretionary income. Collectively, these households reflect the top 10% of the American financial elite, representing approximately 11 million households. The sampling plan ensures adequate representation of loftier economic strata as well, including those described as "wealthy" – with at least $500,000 in annual discretionary income. Each year begins with a "primary wave" of data collection in January and February, followed by at least 200 interviews in data labeled "2011" or "Q1 2011," reflecting the findings from the January/February data collection period, which included 1,458 affluent and wealthy consumers.

Discretionary income was defined by gross income reduced by factors representing property assets (mortgage, taxes). Discretionary household income was used to ensure that the sample represented individuals with a high propensity to spend. The study is nationally projectable within each discretionary income group; sampling error is estimated to be +/- 4%. Multiple panels and starting points were employed to assure proper demographic and psychographic representations within each segment.

The Survey itself addressed many aspects of respondent lifestyle, values, shopping habits, brand preferences, family characteristics, sources of success and wealth, attitudes toward money, lifestyles and media consumption. Monthly fielding and quarterly reporting will continue in 2011.