YouGov’s Household Economic Activity Tracker (HEAT) Index report for August 2012 finds that U.S. household economic activity has improved as job security and business activity picks up and the outlook for housing is strong.

- YouGov’s HEAT Index rose slightly from 98 to 99, as U.S. households report a pickup of economic activity in August. The index now stands four points above its average over the last 18 months, and just a shade below the all-time high of 100.

- When asked about the future, three-quarters of respondents do not anticipate further deterioration in their financial position.

- Though households are not wildly optimistic about their finances over the next year, it is encouraging that future consumer optimism has held up relatively well.

Chart 1: US HEAT Index (100=Neutral)

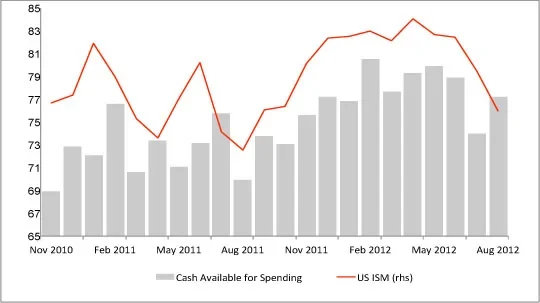

Americans reported a greater sense of job security – 12% of employed respondents say that they feel more secure in their job this month than they did last. And when asked about the outlook for possibility of a layoff, 60% see this as an “unlikely” event. What is especially striking is that this improvement in job security comes as working respondents report a pick-up in activity at their place of business. 22% report “higher” business activity over the last month, up two percentage points from last month, and fewer report “lower” activity. As U.S. business activity as measured by the ISM was essentially flat for the month of July, we are encouraged by the potential improvement that signalled by HEAT for August.

Chart 2: Business Activity and U.S. ISM (100=No Change)

Housing market improvement is a bright spot in the August survey data. Homeowners’ assessment of the value of their home is largely unchanged since last month, with 69% believing the value of their home to be the same or higher than last month. But as homeowners look out over the next 12 months, they see improvement: 25% expect outright home price increases and 49% expect no change.

And while this survey provides lots of reasons to be cheerful – there are a few areas of concern that are worth noting. Even as general activity improved, respondents are less positive about the shopping environment. 32% say the environment for making a major purchases is “worse” than it was a month ago – an increase 4 percentage points since July. This comes even as respondents report that their household has more cash available for spending.

Chart 3: Purchase Environment and Cash (100=No Change)

Another source of concern is when respondents are asked about their financial outlook over next year. Here the picture has deteriorated somewhat – although 73% of respondents think their financial situation will be unchanged or better a year from now, this is down slightly from last month. But if job security and household cash continues to improve, improvement in this indicator should follow.

Economist David Bowers, global strategist at Absolute Strategy Research commented on the results: “The economic conditions captured in the HEAT survey improved in August. The outlook for housing continues to improve, and respondents have more cash to spend. Most encouragingly, respondents are enthusiastic about business activity – this survey data suggests there could be upside to the next round of manufacturing data releases.”

“The improvement in consumer outlook is marginal but promising" said Michael Nardis, Senior Vice President at YouGov. "As Americans feel more secure in their jobs, this may have a positive impact on spending. The data shows that people feel they have more cash available which could be good news for US retail.”

Methodology

The YouGov Household Economic Activity Tracker is a monthly review of the key indicators of consumer confidence. It provides statistical results from the month reviewed to indicate consumer confidence for the month that was. The indicators included in this post are:

- Household financial situation

- Job security

- Workplace activity levels

Fieldwork was conducted from August 1 - August 14, with a nationally representative sample drawn from YouGov's online panel of US residents. 3,573 US residents over the age of 18 were interviewed for this research.