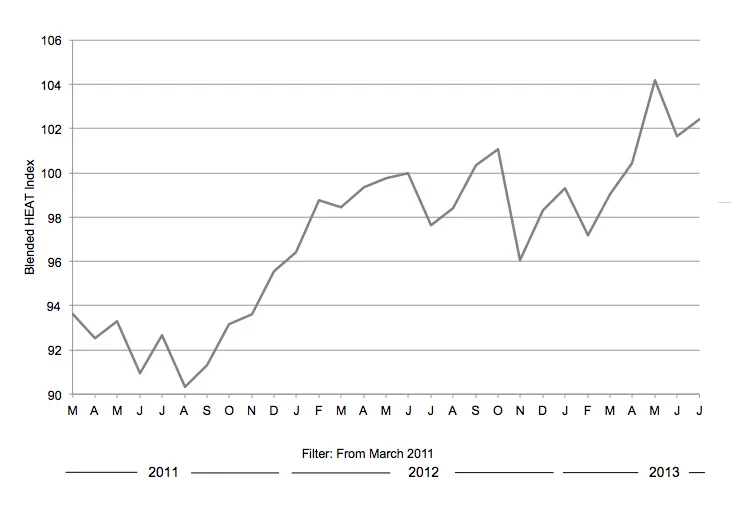

The July 2013 US Household Economic Activity Tracker (HEAT) figures from YouGov show that despite an all-time high confidence in home value growth, Americans remain pessimistic over their employment prospects.

The HEAT Index has not changed from 102 in June with a positive view of making major purchases and a perceived increase in property values keeping the Index scores positive. The Index is on a 0-200 scale, where a score above 100 is positive and a score below 100 indicates negative sentiment.

More confidence in making major buys

The major purchase index reached a near three-year high in July, to 86 from 82 in June. Although the score remains in negative perception, 9% of Americans feel it is a better environment to make a major purchase such as a car, household appliance or a vacation in July than in June, while 23% think it is worse.

The amount of cash available to consumers has risen since last month, according to 8% of respondents. The cash available for spending index remains in the negative but saw slight improvement in July – 28% thought they had less money to spend than last month, while 64% observed no change.

Cash confidence among the younger demographic is at an all-time high, as 13% of 18-34 year olds said they had more cash to spend than last month, compared with 14% who said they were worse off. In June, just one in ten (10%) of 18-34 year olds said they had more cash available than the previous month, compared with 19% who said they were worse off.

Housing outlook reaches all-time high

Homeowner confidence continues to grow amid movement in the US housing market. The home value index is at a high since the HEAT tracker began in November 2011, with 16% of homeowners reporting they thought their house had risen in value in the past month. 18% observed a fall in their property value throughout July.

Higher earners are more cautious in July than in June on the price movement of their property. Among Americans earning $100,000 or more each year, 21% said their property had increased in value through July, and 19% observed a decrease – still a more positive outlook than the consumer average – while in June 23% of higher earners had observed an improvement and 18% a fall in the value of their home.

As the housing market continues its bullish performance in 2013, homeowners are less wary of a housing bubble in the coming year. Expectations of house values remain positive among US homeowners with an Index score of 107, down from 110 in June. 27% of homeowners predict the value of their property will increase in the next 12 months and 20% expect a lower value in a year’s time. This is a slight downturn from last month, when in June 29% predicted a rise and 19% predicted a fall in house values in the next year.

The improved outlook took place amid a continued upswing in the housing market in many parts of the US. The all-time low point in confidence in the housing market was in June 2011, when 43% of homeowners thought their property value would decrease in the coming 12 months.

Layoff fears allayed in July

The future outlook for job security has seen considerable improvement since the previous month. The Index score for July reached 120, compared with a three year low of 113 in June 2013.

Out of employed Americans, 44% thought it was very unlikely that they would be laid off or let go from their job, compared with 41% in June. 14% of working Americans thought it was likely, or even very likely, that they would lose their job in the next 12 months, compared with 17% in the previous month.

Higher earners remain pessimistic about their longer term employment prospects – employed Americans earning more than $100,000 have reached an all-time low in perception of their working outlook for the next 12 months. While 44% of this income bracket thought it very unlikely they would lose their job, 19% felt it was likely or very likely they would lose their place of employment in the next year.

Younger workers posted above-average confidence in their job security. July was an all-time high in backward-looking job security among 18-34 year olds, as 23% felt their job was more secure and 10% said it was less secure than the previous month.

Employed Americans have observed a slight downswing in business activity from the previous month. 18% said they saw increased business activity at their place of work during July, while 19% saw business activity slow down during the course of the month. This compares with the 19% of employed Americans who believed business activity had increased in June. Hopes of improved business activity are positive – 27% thought business activity would pick up in the next 12 months, up from 26% in June.

Confidence in administration in downswing

Confidence in the Government’s handling of the economy continues to remain in negative perception – the index has fallen to 61 from 62 the previous month, although it has not reached the 12-month low of 60 from March 2013.

YouGov Household Economic Activity Tracker Index (General Population)

Image courtesy of Getty.