From concept to market: tailored research solutions

Identifying gaps in the market with accurate, unbiased market research for new product development and design can reveal what consumers really crave.

Great data doesn’t just reduce risk, it reveals opportunities others have missed. It’s the reality check you need to validate concepts before investing – from market sizing, competitive and trend analysis, to pricing and consumer research, concept screening and prototype testing.

If you’re designing a new product for retail or business customers, YouGov will help you get it spot on for your target audience.

Innovation isn’t a nice-to-have. It’s the lifeblood nourishing and strengthening your brand. YouGov’s market research for new product development gives you accurate intelligence to bridge the gap between consumer needs and launch success.

30 million+

registered panel members

Target your audience

No matter how niche

Re-contact capabilities

For the ‘why’ behind responses

Winners don’t cut corners

There’s so much at stake when it comes to product development. Bad data doesn’t just slow you down; it points you in the wrong direction.

Brands looking to add lines, introduce a first-of-its-kind product, or improve existing ranges trust YouGov’s intelligence to support accurate decision-making.

Market whispers to product wonders

Let accurate market research and authentic data on target audience segments can inform your product design. Intelligence from real people in YouGov's 30 million+ panel will enable you to:

- Uncover genuine consumer needs

- Check brand fit

- Test concepts

- Find pricing sweet spots

- And much more

From idea to launch-ready

Unlock deeper insights on the ‘why’ behind audience responses with AI-powered language analysis. From need identification and market analysis to concept testing and prototype evaluation, our research will get you fully go-to-market ready.

Spot trends in shopper data no matter your budget, through:

- Surveys direct to target audiences

- Real-life research on the whole population

- Bespoke conjoint analysis

- Custom research

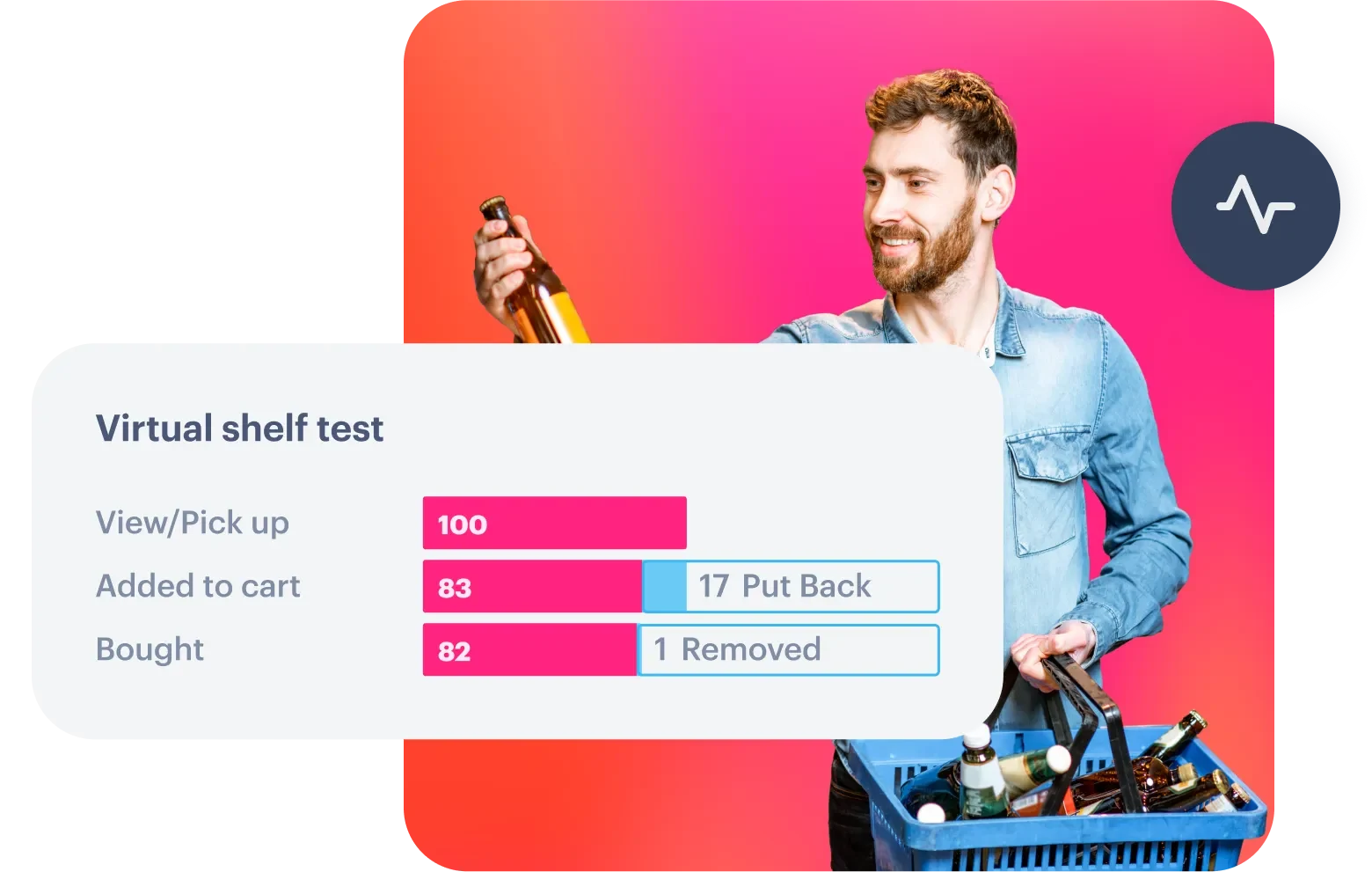

Smart product concept testing that delivers

Want to boost your launch success? It’s all about testing concepts early and refining product designs to determine what consumers really want.

Understand customer needs and create new products that resonate deeply with your target audience / shoppers. Let’s power your decision-making with precise intelligence.

Surveys: Serviced

Quick-turnaround, researcher-supported omnibus and targeted Field & Tab research.Media, comms & channel strategy

Develop messaging that resonates, and reach your audience where they’re most receptive.Identify, size & profile your ideal customer

Audience analysis on segments that will be most receptive to your products and services.Run market research to your audience

From quick surveys to custom research – work with our experts for actionable intelligence.Unpack consumer behavior

Know who buys what, where, how much, how often, and why with shopper intelligence.Not sure what solution you need? Let's chat.

Get in touch

New product development case studies

See how we've delivered essential intelligence for leading brands seeking to develop and launch new products effectively.

“We needed to make an urgent and critical business decision that required a robust evidence base to support it. YouGov Surveys' speed and service over the Christmas period allowed us to make that decision with confidence.”

Rebecca Hargadon, Marketing Manager at Mizkan Euro

Meet our experts

Insight-driven innovation

Discover the research strategies that translate great ideas into market leaders with the latest editorial articles on new product development research.

Market research for product development FAQs

How does YouGov conduct conjoint analysis to measure how consumers value new product features?

Conjoint analysis is a research approach that measures how consumers value the features of products and services. It uses real-life scenarios and identifies the feature combinations to maximize consumer preference. Market decisions are modelled and predicted using statistical techniques.

Respondents are asked to compare different features and how they value each one. This information aids the development of strategies for products, features and pricing. The typical output is preference, showing potential market share, but survey participants can also be asked volume questions. YouGov is uniquely skilled in this volume-based conjoint approach. When directly modelled we make sales predictions with great precision and accuracy.

What is the implicit reaction test and how does it track emotional responses?

Conventional surveys ask questions and collect responses to generate useful data. But there is often a missing dimension: the emotion. People hold many opinions, but only act on some of them, and that can be down to emotional response.

Implicit reaction tests use additional measures, such as the speed of choice. We react more quickly when something matters to us. This tells us much more, suggesting the issue has higher salience and provokes stronger emotions. Using this method repeatedly allows YouGov to add this powerful dimension to our analysis.

Trust YouGov’s market research for new product development

Global brands rely on our data to provide real answers from real people, no matter how niche. We put the consumer at the center of product design by combining survey insights with purchase behavior. Our market research experts work to generate trustworthy intelligence to shape precise product development decisions.