The first step to building a stronger brand is knowing where you stand today. With AI changing the way people discover brands, understanding your brand health becomes more important than ever. Brand tracking tools give you a clear view of how customers see your brand and how that compares with your competitors. By continuously measuring key brand tracking metrics – such as brand awareness, word of mouth, consideration and loyalty - you can stay close to your customers’ changing needs and make smarter decisions about brand positioning.

At its core, brand tracking is about staying in tune with your audience. It tracks how people’s sentiment towards your brand evolves over time, providing a consistent view of performance. Understanding how your brand performs daily helps you reach the right people, in the right way, at the right time.

There’s no single way to track brand health. Some tools focus on metrics across the marketing funnel - from awareness and perception to consideration and loyalty. Others lean on social listening or AI-assisted analysis. The right choice depends on your goals, your target audience, and the depth of data you need.

What remains constant is the need for reliable data from real people’s opinions. Without it, brand tracking is just noise and guesswork. Where is your current brand tracking data coming from? Are you happy basing your brand or marketing strategy on something you can't fully trust, or verify? It’s important to put your brand into context with accuracy. The best brand tracking tools combine accurate data, innovative technology, and intuitive design, to give you a true view of your brand’s health.

In this how-to guide, we explore today’s leading brand tracking solutions – examining how each measures performance and where they can help (or fall short) depending on your needs.

10 best brand tracking tools for detailed brand measurement

Explore our breakdown of 10 leading brand monitoring platforms below, where we outline key features and ideal use cases to guide you toward the best choice for your team.

#1 YouGov BrandIndex

Best for: Brand marketers and researchers that want industry-leading daily brand tracking, based on accurate, trusted panel data from over 30 million members. From always-on daily tracking to one-off BrandIndex snapshots, brand trackers and custom studies, YouGov has brand health tracking to suit all needs.

YouGov BrandIndex is our flagship daily brand tracking platform, measuring 16 brand health metrics using the opinions of more than 30 million registered panel members. YouGov BrandIndex is one of the few brand trackers that offers daily brand tracking. Operating in 55 markets and covering over 27,000 brands, it offers continuous insight into how consumers view and engage with brands around the world.

Overview

YouGov BrandIndex tracks changes in perception across the full consumer journey – from awareness and consideration to satisfaction and loyalty. The platform provides daily updates from online surveys with YouGov’s global panel, helping users monitor shifts in sentiment, benchmark performance, and understand market positioning over time.

Built-in features such as ‘News’ allow users to map brand performance against external events, showing how campaigns or wider trends may influence perception.

There’s also the option to commission additional trigger questions, re-contacting the same panel members to understand the reasons behind brand shifts and changes in perception. Thanks to YouGov’s connected data, users can apply the QualAI feature to summarize open-ended qualitative responses to the ‘why’ behind their opinions and experiences of your brand, and connect quantifiable numerical results to the real human reasoning behind them – next level, human-centric brand tracking insights.

Customer support

Subscribers receive direct support from YouGov’s Client Services and Account Management teams, ensuring smooth onboarding and ongoing guidance. Training, regular check-ins, and quarterly reviews help users get the most out of their data, while our always-on, digital help desk platform offers detailed product guides and demos for self-service use and instant answers to your questions. We’ll identify your goals for the tool, what you want to achieve with our data, and then make sure you reach that point of success by regularly checking in on real measures of success.

Key features

- Daily brand tracking across 16 brand health metrics

- High-quality data from 30m+ verified panel members

- Benchmark brand performance against competitors

- Coverage of 27,000+ brands around the globe, across 55 markets

- News feature linking metrics to real-world events

- Understand the why behind the metrics, with AI-powered qualitative re-contact insight available via QualAI

Pricing

Custom pricing model. A free version, BrandIndex Lite, is also offered.

Pros

- Continuous daily tracking across all key sectors globally

- 18 years of historical data

- Large, verified consumer panel owned by YouGov

- Industry-leading data quality with multi-layer fraud detection and AI quality checks

- Representative sampling utilizing probabilistic weighting to align samples with census data

- Flexible access options for your requirements - freemium, API delivery, data snapshot, subscription

- Always-on, intuitive dashboards for accessible trend analysis

- Respondent level data available for deeper analysis

- Qualitative insights available to dig deeper and understand the ‘why’ behind brand tracking metrics and brand shifts using AI-analysis of open-ended responses

- Hands-on onboarding and unlimited support at no extra cost

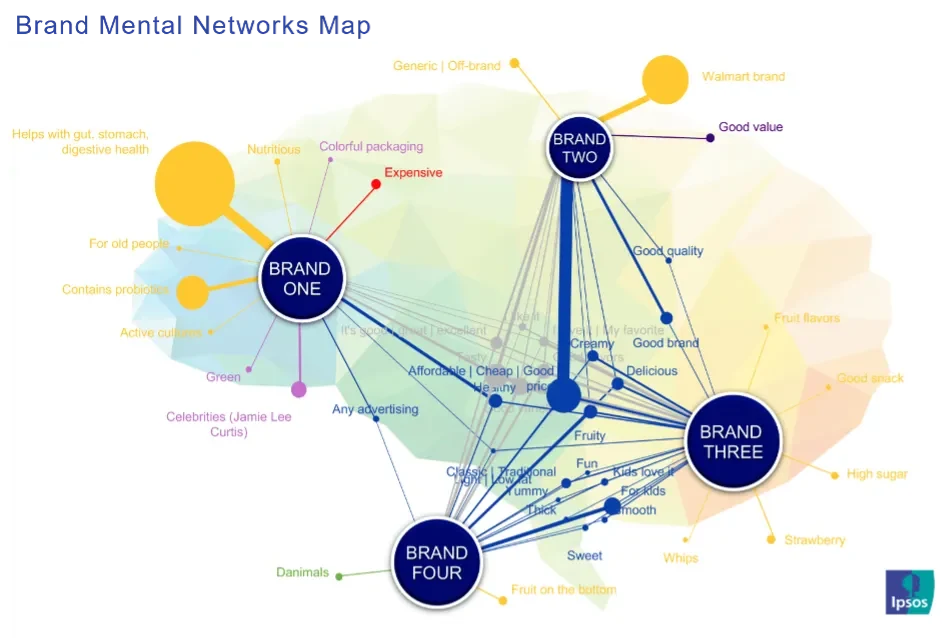

#2 Ipsos Brand Health Tracking

Best for: Teams wanting periodic survey-based brand diagnostics.

Overview

Ipsos Brand Health Tracking is a survey-based solution designed to help brands monitor performance and identify growth opportunities. It provides a suite of proprietary tools - including Brand Value Creator, Brand Mental Networks, Brand Signals, and Activation Impact Modeling - to assess how consumers perceive and engage with brands.

The service uses customer survey data to explore audience needs and motivations, producing visual analytics.

Key features

- Uses customer survey data to understand the wants and needs of the customer

- Provides visual outputs to illustrate brand performance

- Brand Signals unlocks the option to combine survey insights with social media mentions

Pricing

Custom pricing.

Pros

- Clear visual diagrams for analytics

- Flexible tools that adapt to specific brand KPIs

- Provide AI-powered insights on opportunities and threats via Brand Signals

- Support available through Ipsos’ research team

Cons

- Platform can require training to navigate due to data complexity

- Occasionally low-quality survey responses (G2)

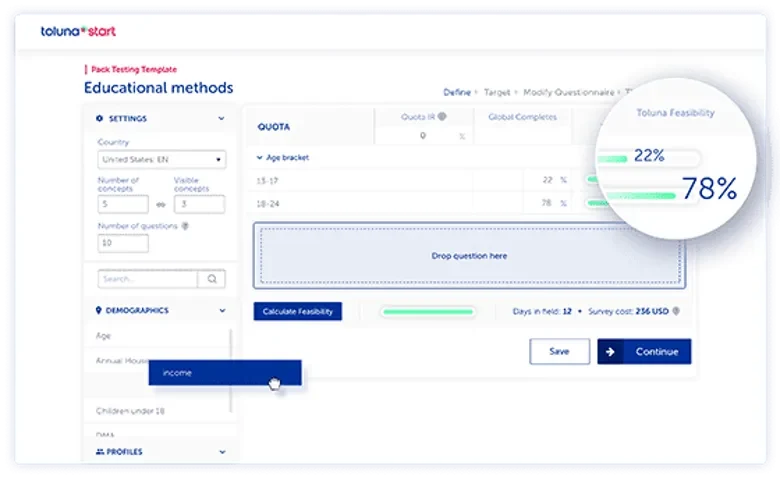

#3 Toluna Tempo and Brand Fame

Best for: Brands that want survey insights and social listening, managed through two separate tracking tools.

Toluna Start offers two complementary brand tracking solutions - Tempo and Brand Fame. Tempo uses survey-based insights from Toluna’s global panel to monitor brand health, while Brand Fame applies social listening to assess perception, sentiment and reputation across digital channels.

Both tools are designed to deliver actionable results: Tempo helps brands identify key performance indicators and objectives, while Brand Fame offers recommendations based on audience conversations. The two can be used independently or combined for a broader, multi-source view of brand health.

Key features

- Tempo gathers data from Toluna’s Global Panel Community of 79+ million survey participants

- Brand Fame monitors consumer generated content for sentiment and reputation

- Custom KPIs and objectives suggested within Tempo

- Strategic improvement recommendations within Brand Fame

- Tools can be used together

Pricing

- Custom pricing, not disclosed.

Pros

- Consultant-led support throughout the purchase and setup

- Panel of 79m+ with global coverage

- AI features available for the analysis and theme extraction of survey responses

Cons

- Some users have data quality concerns due to the size of the panel (GetApp review)

- Separate purchases required to combine survey and social data

- Described as a steep learning curve for new users (G2)

- Interface can feel cluttered when managing multiple cross-tabs (G2)

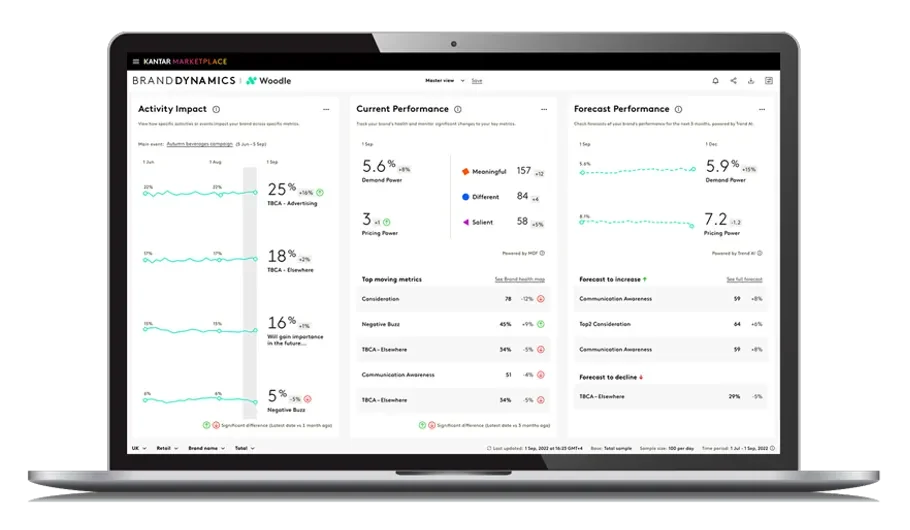

#4 Kantar Brand Dynamics

Best for: Organizations looking for periodic brand tracking supported by Kantar's modeling frameworks.

Overview

Kantar Brand Dynamics is a daily brand health tracking platform built on the Profiles Audience Network, analyzing key brand performance metrics and benchmarking results against category competitors. It uses a combination of traditional survey research and AI-enhanced data to provide a forward-looking view of brand health.

The tool helps brands understand how perception shifts over time and forecasts brand performance for the next three months, allowing teams to act early and stay ahead of competitors.

Key features

- Daily brand tracking using Profiles Audience Network data

- Benchmarks performance against competitors within your category

- AI-driven modeling to supplement brand performance signals

- Forecasts capabilities to project brand health for up to three months ahead

- Simple platform interface for easy visualization and analysis

Pricing

Custom pricing.

Pros

- Global coverage across 38 markets

- Flexible self-service platform

- Eight hours of consultancy time per quarter included

- AI tools to forecast future brand health and identify category trends

- Automated reports

- Customer support via client success team and on-demand help center

Cons

- Limited in consultancy time; additional support requires an upgrade

- Predictive modeling outputs vary depending on available data inputs and methodology

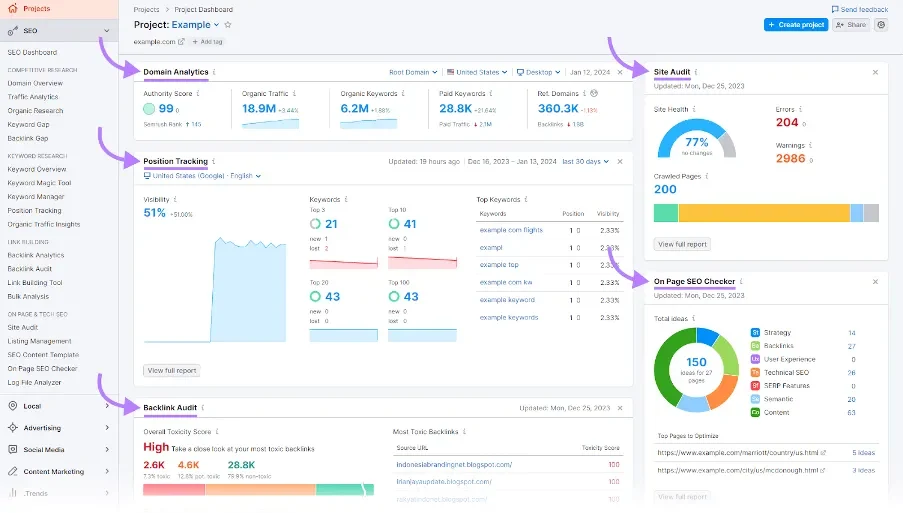

#5 SEMrush

Best for: Teams tracking search visibility and SEO signals as indicators of brand performance.

Overview

SEMrush is primarily an SEO and digital marketing platform, but it also includes a brand tracking dashboard that can be used to monitor brand visibility online. The tool tracks search rankings, backlinks, and keyword performance to build a view of how a brand is performing across digital channels.

Users can set up custom alerts and automated email digests (daily, weekly, or monthly) to stay informed about fluctuations in rankings or brand mentions, helping teams respond quickly to opportunities or risks. The dashboard displays analytics through visual charts and allows competitive analysis by tracking other brands within the same category.

Key features

- Brand tracking dashboard covering search rankings, social media mentions, keywords and backlinks

- Email notifications and automated digests for performance updates

- Visual dashboards for data visualization and analysis

- Competitive tracking against multiple brands

- AI-powered analysis and writing assistance

Pricing

Plans start from $139.95/month (SEO tier)

Pros

- Provides alerts for potential PR and visibility opportunities

- User-friendly dashboards for quick insights

- AI summary tool generates automated insights

- Supports SEO content creation via integrated AI writing assistant

Cons

- Broad range of tools and features can make navigation complex for new users

- Additional cost for extra tools and user seats

- Limited to only social listening/online visibility tracking of your brand

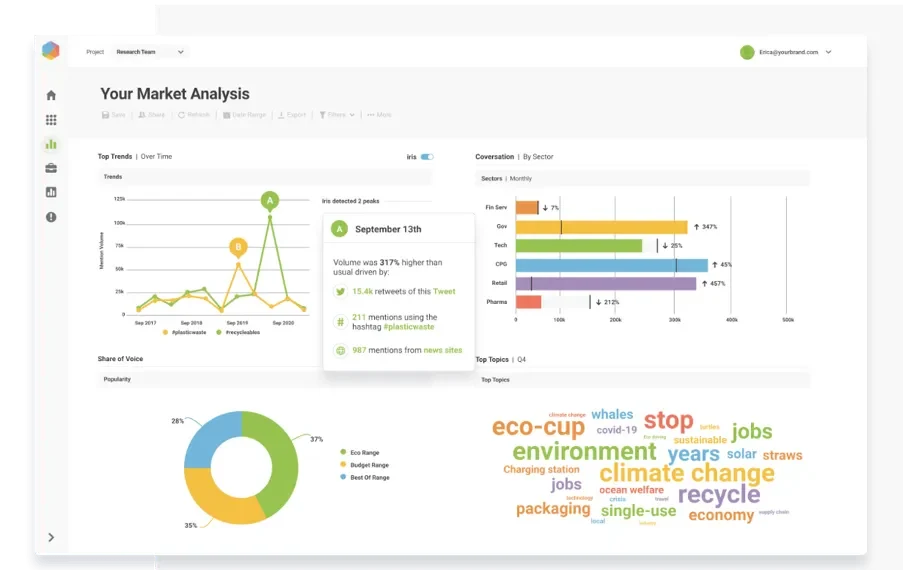

#6 Brandwatch

Best for: Brands focused on monitoring online mentions and visual logo usage across digital channels.

Overview

Brandwatch is a social listening and social media monitoring platform that helps brands track mentions, sentiment and visibility across digital channels. It analyses where and how a brand appears online - including websites, social media, broadcasts and print - to deliver insights into brand perception and share of voice.

The platform supports multi-year tracking, allowing users to develop historical insights into brand health over time. AI-powered analysis tools process large volumes of online data, while real-time alerts and reports help teams respond quickly to trends and potential reputational issues.

Key features

- Tracks brand, product and logo mentions across web, broadcast and print

- Conducts multi-year tracking for historical brand insights

- Benchmarks brand health and share of voice

- AI-powered analytics

- Real-time alerts and performance reporting

Pricing

Custom pricing.

Pros

- Visual tracking capabilities, including logo recognition in online content

- Easy-to-use dashboard with automated reporting

- Guaranteed customer support responses within 24hrs

Cons

- Platform can lag under heavy use (as noted by G2 reviewers)

- Relies on social and digital data rather than survey data

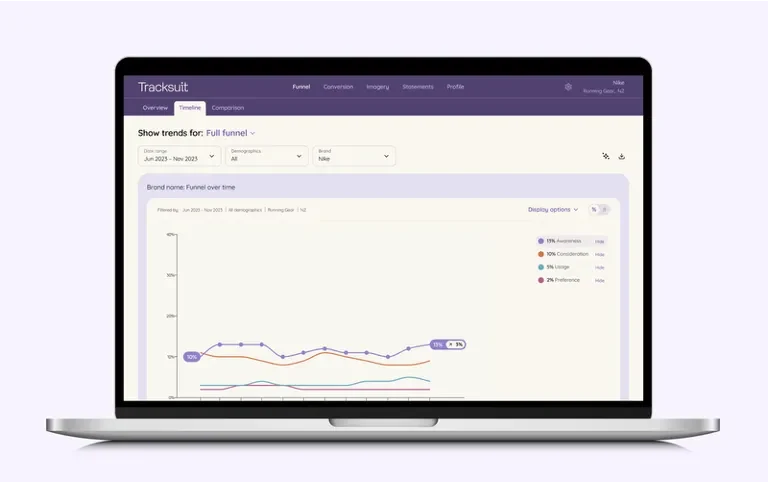

#7 Tracksuit

Best for: Brands wanting a simple, easy-to-use dashboard for basic brand tracking.

Overview

Tracksuit provides continuous tracking of brand health metrics using third-party survey data. It measures performance across the marketing funnel as well as brand perceptions and category attributes.

The platform offers an always-on dashboard with three key views:

- Timeline: Tracks how brand metrics change over time.

- Funnel: Shows total potential audience and category penetration.

- Imagery: Visually presents brand perception compared with competitors.

Key features

- Always-on dashboard with real-time metric visualization

- Data sourced through the third-party panel provider Dynata

- AI-powered tools including an AI-generated text summarizer and Coach’s Notes, an AI-generated insights dashboard

- Milestone feature allows users to add future brand milestones to timeline charts to contextualize results

Pricing

Prices begin at £15,000/year.

Pros

- Lower-cost entry point

- Easy to navigate interface with visual representations in timelines, charts, imagery

- Always-on self-service dashboard

Cons

- Additional cost to track extra competitor brands

- Limited to 8 markets

- Smaller sample sizes

- Data drawn from third-party panels rather than proprietary sources

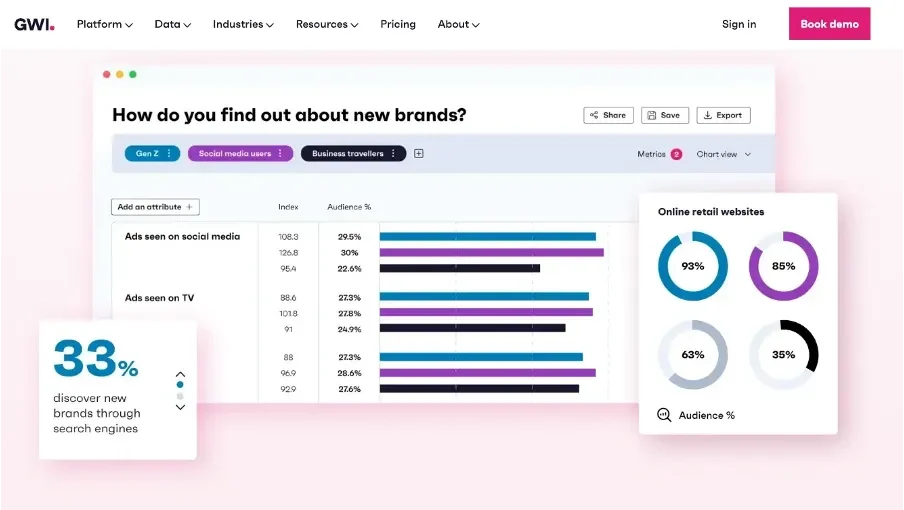

#8 GWI

Best for: Teams who are doing project-based tracking through reports.

GWI offers a brand tracking service built around custom research program design. The platform measures brand performance across the marketing funnel and provides detailed analysis and reporting to deliver actionable insights. It also uses audience profiling data to help brands understand where potential customers may be falling out of the funnel and how to optimize messaging or targeting.

Key features

- Custom brand tracking designed to specific business objectives

- Measures brand presence, sentiment, and funnel performance over time

- Access to 57K profiling points for audience segmentation

Pricing

Starts at £120 per user per month.

Pros

- Fully customizable to brand-specific research needs

- Tracks ROI and brand funnel performance

- Incorporates AI features within its interface, including GWI Spark, a Generative AI assistant

- Global dataset for cross-market comparison

- GWI conducts fraud checks and works with prevention suppliers to help ensure data quality

Cons

- Relies on third-party panel partners for respondent recruitment, which may affect data consistency

- Some users report difficulty translating insights into practical actions due to variations in data accuracy (via G2)

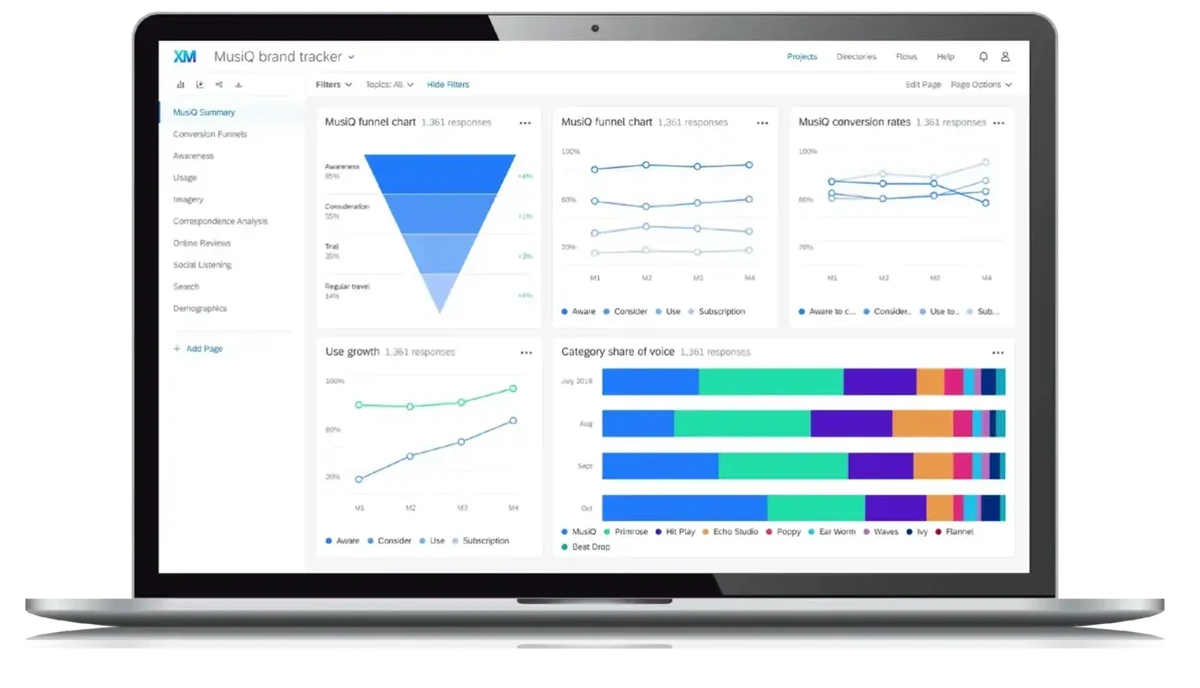

#9 Qualtrics Brand Tracker

Best for: Brands who want to layer external social media data on top of brand tracking results.

Overview

Qualtrics Brand Tracker is an always-on brand tracking platform designed to measure brand health in real time. It gathers data from multiple sources - including survey results and external datasets - to give brands a consolidated view of awareness, perception, and sentiment.

The tool also enables users to add external brand data to understand how outside factors may be influencing performance. Brand tracking is supported by Qualtrics’ team of research experts, who manage survey design, data collection and analysis to ensure representative, census-aligned results.

Key features

- Centralized brand health tracking across multiple metrics

- Ability to integrate external data sources for added context

- Always-on brand intelligence

- AI-powered analysis for faster, more detailed insights

Pricing

Custom pricing, not disclosed

Pros

- Capable of reaching more or hard-to-access audiences

- Research team support throughout full survey process

- Aim to achieve representative sampling aligned to census data

- Measures ROI and identifies areas for improvements

- AI features including AI-driven dashboard summarizers

Cons

- Limited customization; survey setup is managed by Qualtrics’ research team

- Limited learning materials and user tutorials for a complex interface (as reported by G2)

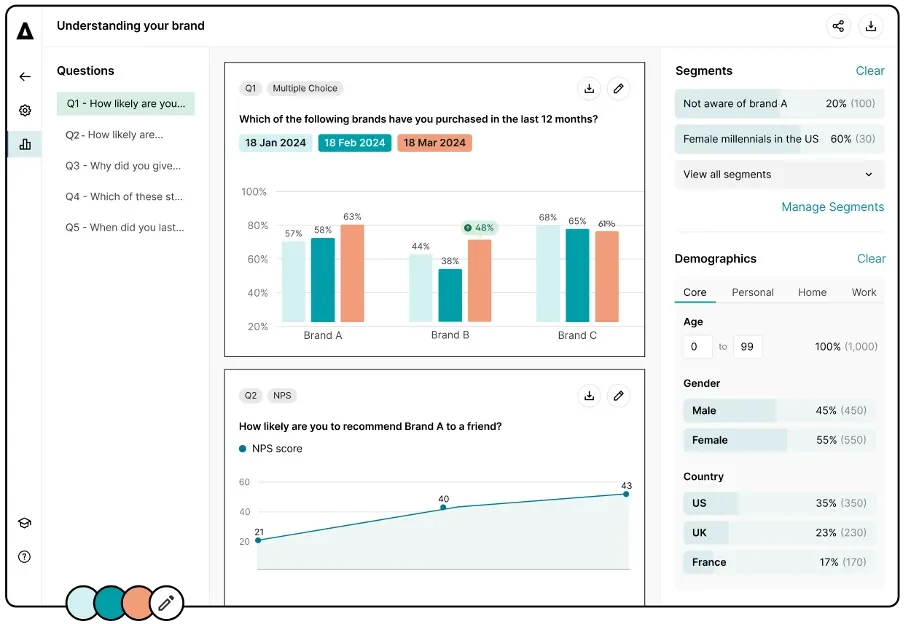

#10 Attest

Best for: Teams who want fast insights sourced from multiple panels.

Overview

Attest is a self-service research platform for quick, survey-based insights into awareness, perception, and audience attitudes. It’s geared towards short-turnaround brand tracking studies (rather than continuous daily tracking), making it well suited to campaign read-outs or testing specific brand hypotheses. Users build and distribute surveys to a global audience via Attest’s integrated respondent network, with results visualized in a dashboard for easy comparison across campaigns or markets.

Key features

- Multi-panel approach for broad consumer reach

- Custom brand health questions with templated options

- Tracker cadence options (e.g. recur at 1, 3 or 6 months)

- Audience targeting and segment comparison across markets

- Dashboard visualization for trends and cross-campaign views

Pricing

Three tiers: Basic, standard and elite.

Pros

- Three pricing tiers for flexible research costs

- Human support available from research team

- Fast fieldwork (average survey turnaround reported as ~1 day 19 hours)

- Large respondent reach with localization for language / market

Cons

- High perceived cost (according to G2)

- Niche / B2B audiences are challenging to reach

- Multi-panel sourcing may require additional fraud checks; Attest reports using quality controls

Frequently asked questions

Why use brand tracking software?

Brand tracking software gives you a continuous, comparable view of brand health so you can see what’s improving, what’s slipping, and why tracking isn’t just about your own brand either - benchmarking against competitors shows the strength of your market positioning and where you’re gaining or losing ground.

By tracking metrics across the full marketing funnel (from awareness and consideration to satisfaction, loyalty, and intent), you see how audiences move through each stage - and where they drop off. That makes it easier to connect shifts to campaigns or external events, set clear success measures, and adapt strategy with confidence. Users of BrandIndex often spot crises or opportunities as they unfold, thanks to daily data, so they can act quickly and adapt their strategy to positively impact their brand health over time.

What should I look for in a brand tracking tool?

Start with data quality and methodology transparency; look for a leader in data accuracy like YouGov, who discloses its panel and methodology openly and is recognized as an industry leader. Then assess whether the tool will help you act with useful insights.

- Verified, high-quality data with fraud detection and clear sampling/methods.

- Full-funnel metrics (awareness → consideration → loyalty/purchase) to show where movement happens.

- Always-on cadence with daily or frequent updates to pinpoint inflection points.

- Speed and alerts so you can respond to dips or opportunities quickly.

- Usability and support - onboarding, training, documentation, and access to people when needed.

- Analysis features - filters, audience cuts, AI-assisted summaries, and clear visualizations for decision-making.

How do brand tracking tools work?

Brand trackers collect data on agreed metrics and present shifts over time in a dashboard.

- Survey-based trackers gather responses from defined audiences (customers, target segments, general population). This is the most direct way to measure perceptions, consideration, and experience. When the panel behind the data is real, verified and owned, like YouGov BrandIndex, the data is more likely to be representative and accurate.

- Social listening trackers analyse online mentions, sentiment, and share of voice. Useful for reputation and conversation trends, but not a substitute for asking people directly.

- Custom/bespoke research addresses specific questions (e.g., quarterly deep dives or qualitative work) and can complement an always-on tracker.

Workflow: choose methodology → define metrics and audiences → field continuously or at set intervals → monitor trends → diagnose changes → act and re-measure.

How often should you track your brand’s performance?

If you want to understand change as it happens, daily, always-on tracking is the gold standard. It reveals precisely when sentiment moves and what may have driven it.

If daily isn’t feasible, run a consistent cadence (e.g. monthly or quarterly) and keep methodology identical so results are comparable over time. YouGov offers flexible options; YouGov BrandIndex is an always-on brand tracking tool with daily data, as well as other snapshot or custom tracker options to suit your budget and needs.

What is the cost of a brand tracking tool?

Costs vary by methodology, sample size, number of markets, update frequency, and feature set. Lower-entry options may start at per-user monthly pricing, while global, survey-based, always-on tracking is typically custom-priced to your markets, brands, and competitors. When comparing, look beyond headline price to what you get: data accuracy, panel ownership and transparency, sample quality, markets available, historical access, and support levels.

Are there free brand tracking tools?

Some providers offer free tiers or trials to explore functionality. YouGov BrandIndex Lite provides one brand health metric with monthly updates over a one-month average to illustrate how tracking works. Check each provider’s terms to understand limitations (metrics, historical depth, markets, users).

How to measure your brand health?

Brand health is best measured with a structured set of metrics aligned to the funnel and to perceptions.

Example (YouGov BrandIndex) - 16 metrics across three areas:

1. Media & communication

- Advertising Awareness

- Aided Brand Awareness

- Attention

- Buzz

- Word of Mouth Exposure

2. Brand perception

- General Impression

- Customer Satisfaction

- Quality

- Value

- Corporate Reputation

- Recommendation

- Index (overall brand health composite)

3. Purchase funnel

- Purchase Intent

- Consideration

- Current Customer

- Former Customer

Using a consistent question set over time lets you spot shifts early, diagnose drivers, and attribute impact to campaigns or external events.

For more detailed guidance into how to measure brand health and what all the brand health metrics mean, you can read our how-to guide.

What is the best brand tracking tool for global brands?

Global brands need true multi-market coverage, audience filtering, and always-on updates so regional teams can act locally while leadership sees the global picture.

YouGov BrandIndex’s brand tracking covers tens of thousands of brands across 55 markets, with daily surveying and audience filters that let users cut by market, segment, and time window. If global comparability and daily reads are priorities, a survey-based, multi-market tracker is typically the most reliable approach.

What is the best tool for continuous daily tracking?

For reliable daily reads, survey-based platforms with large, verified panels are best placed to deliver consistent, comparable data. YouGov runs daily surveys across global panels and surfaces results in YouGov BrandIndex, an always-on dashboard with filters down to exact dates, helping you link movements to specific events and diagnose spikes using features like QualAI for open-ended responses.

How do you measure brand awareness?

Measure both recognition and recall:

- Survey-based: Ask aided/unaided awareness questions to understand recognition and recall within target audiences.

- Digital/contextual indicators: Complement with branded search trends, share of voice, website traffic, and earned media - but treat these as context, not replacements for survey measures.

- Social listening: Monitor mentions and reach to understand conversation volume and tone.

For an in-depth framework, pair awareness with consideration and usage to understand whether awareness is translating into demand.

For more information on alternative methods of measuring brand awareness and detailed guidance on determining it, check out our how-to guide.

What is the best brand tracking tool for FMCG brands?

FMCG requires fast reads, competitor benchmarking, and robust data quality across crowded categories. YouGov BrandIndex provides daily updates and category benchmarking, enabling brand and shopper teams to react quickly to promotions, distribution shifts, and seasonal effects with confidence in the underlying data.

What is the best brand tracking tool for tech companies?

Tech brands operate in a high-velocity environment and need daily tracking, competitor benchmarking, and diagnostic tools that keep pace with product launches and comms cycles. YouGov BrandIndex offers always-on tracking, plus AI-assisted analysis (QualAI), to summarize open-ended responses - helping product and marketing teams connect the “what” to the “why” without sacrificing data quality.

If you enjoyed reading this, take a look below at some additional resources we thought you might like: