In a world where shoppers make hundreds of micro-decisions every day, many of the important ones often disappear almost as quickly as they happen.

For marketers on both the brand and retail side, one powerful way to understand why a purchase happened is to catch that decision while it’s still vivid – before logic, habit, and hindsight rewrite the story. The shelf cue, the offer, the layout, the impulse, the need state: these signals fade fast.

Wait even a few days and recall becomes rationalized, details blur, and emotional truth of the moment is lost. That’s why insights captured close to the purchase moment aren’t just faster – they’re more accurate. They reveal the unfiltered motivations that delayed research often misses.

Alongside the stable shopping habits in a category and the long-term attitudes toward brands, there are the ‘sparks’: the in-the-moment triggers, immediate reactions and situational needs that shape decisions. Capturing those sparks adds a new layer to the shopper data, driving deeper and clearer insight.

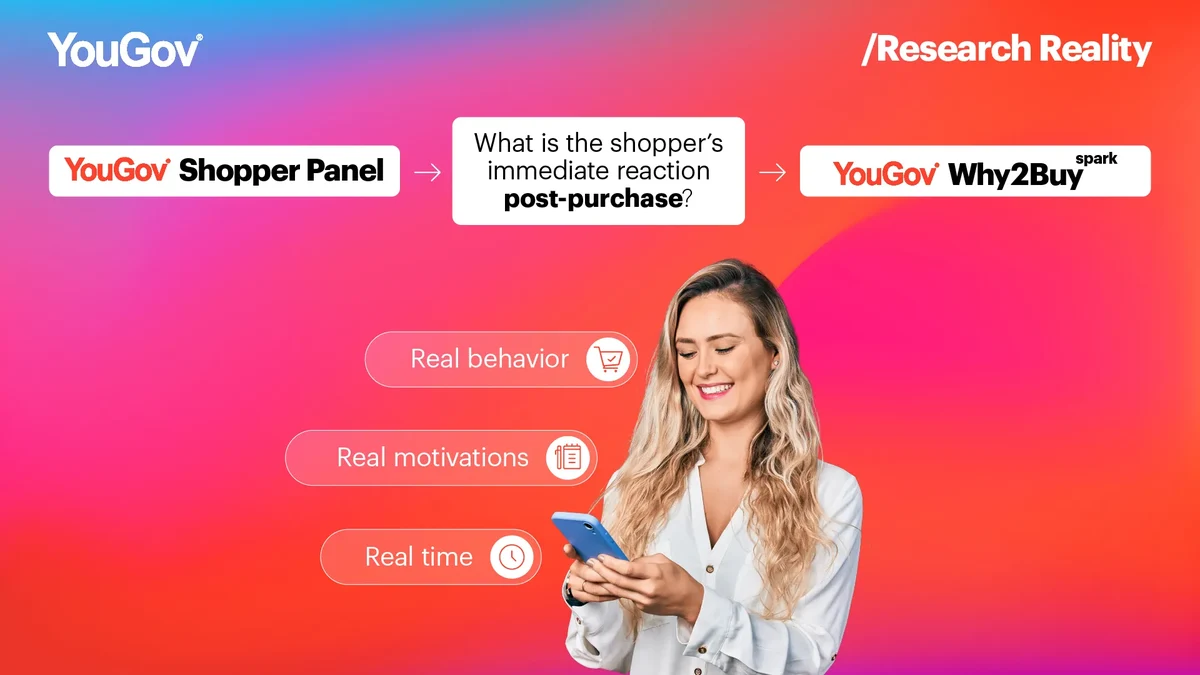

This is the thinking behind purchase-triggered, near-moment research approaches such as YouGov Why2Buyspark, which connect with shoppers shortly after purchase, while context is still intact and motivations remain fresh.

For a long time, YouGov Why2Buy surveys have helped brands and retailers understand not only what people buy, but why they buy it – linking stated motivations, attitudes and decision drivers to real purchasing behavior across categories and markets.

YouGov Why2Buyspark now extends that capability into the critical moment right after purchase. By triggering surveys close to the shopping event, Spark captures in-the-moment context – adding a powerful new layer of immediacy to the established Why2Buy approach.

Together, Why2Buy and Why2Buyspark provide a more complete view of shopper decision-making: from long-term attitudes and habits to the sparks that ignite each individual choice.

Where fresh shopper insights make the biggest difference

These are the areas where fresh insights deliver the biggest impact:

1. Understanding real purchase decisions

Day-after-purchase surveys reveal which choices are deliberate versus spontaneous, what criteria drive selection (brand, price, pack size, flavor, promotion), and how decision trees unfold at the shelf or online.

2. Mapping touchpoints that truly influence

When feedback is captured straight after purchase, it becomes clear which touchpoints really mattered – the ad noticed, the review read, the display seen. This exposes the real path to conversion and the sequence of moments that shaped the final choice.

3. Linking purchases to real-life moments

Many choices only make sense in context: a snack for comfort, a meal for convenience, a drink for energy. Day-after-use feedback captures genuine emotional and situational triggers, helping brands and retailers design offers that fit real occasions.

4. Evaluating new products and innovations

Triggered surveys reveal how new products perform in real life – what caught attention, how the product delivered, and where expectations fell short. That feedback helps refine future launches and strengthen innovation decisions with evidence grounded in real experience.

5. Revealing shopper experience and loyalty drivers

Small experiences shape long-term loyalty: a stockout, a long queue, a helpful interaction. Broad-reach, just-after-visit feedback across retailers and competitors highlights what truly drives satisfaction before small frustrations become lost customers.

How to turn fresh shopper moments into lasting impact

Capturing insight is only the first step. The real value comes from how it is applied. Here’s how to make this approach work for your brand, category, or store:

1. Start with the right shoppers

Speak to people who have actually just bought in your category or store. Refine targeting using demographics, habits, and attitudes to ensure every response reflects a real, commercially relevant experience.

2. Capture feedback close to the decision moment

Timing shapes truth. Near-moment feedback preserves the emotion, context, and trade-offs behind each choice – whether it’s a quick top-up shop, a weekend trial, or an online click.

3. Focus on what matters most

Keep surveys concise and purposeful: Was it planned or spontaneous? Which options were considered? What sealed the choice? Simplicity keeps insights actionable.

4. Explore the ‘why’ behind the buy

Go beyond what people purchased to uncover motivation: convenience, comfort, or value, reassurance, inspiration. This is where a strategic advantage emerges.

5. Combine fast data with human expertise

Speeding alone isn’t enough. The strongest results come from combining real-time data collection with expert interpretation – turning feedback into clear commercial direction.

6. Turn shopper intelligence into real-world impact

Feed fresh survey insights directly into campaigns, category plans, and store improvements. Continuous learning keeps brands and retailers aligned with how people really shop.

Bringing it all together

Real shoppers. Real motivations. Real time.

That’s the power of purchase-triggered surveys. By combining immediacy with interpretation, brands and retailers gain a deeper, more human understanding of why people buy – and what they’ll buy next. Triggered research approaches like YouGov Why2Buyspark make this possible, but it’s how these principles are applied that creates lasting impact.