The NFL’s Christmas Day experiment is evolving into a bigger annual moment – especially as games spread across platforms like Netflix and Amazon Prime Video. How are these matches performing among fans in the U.S. and elsewhere? YouGov data reveals a clear split: While Christmas Day NFL is already mainstream in the U.S., it is still a niche, mostly youth-driven viewing occasion in Great Britain.

Great Britain: Christmas Day NFL struggles to break through, but gains traction among younger audiences

In Great Britain, NFL games continue to sit outside most people’s festive viewing habits. Around 94% of adults did not watch any of the Christmas Day games, highlighting that the league’s reach remains limited. Each of the three matches reached 2-3% of the overall population, according to a poll conducted via YouGov Surveys: Self-serve.

Among younger adults, however, the NFL performs noticeably better than among the overall population. In Britain, 18–34s were the most likely to tune in, with between 5-7% of this cohort tuning in for each game. Overall, about 12% of younger Brits said they watched at least one of the three Christmas Day NFL matches. While still not mass-market, this signals momentum among younger audiences.

U.S.: NFL Christmas Day games continue to shine as a mainstream holiday staple

The picture in the U.S. is very different. Across all adults, over a third of Americans watched at least one NFL Christmas Day game (with 64% saying none). Unlike Great Britain, where interest clusters among younger viewers, viewing was consistent across age groups – with a slight skew towards older adults.

Watching habits are similar, but the social context differs

Where people watched also tells a story about how Christmas Day NFL fits into the wider holiday routine. In both Great Britain and the U.S., most viewers tuned in from home with family and/or friends – 50% in Britain and 53% in the U.S. – suggesting the games generally slot into existing Christmas Day patterns.

But the type of gathering varies: Americans were more likely to watch at a family member’s home (24%), while Britons were more likely to be watching at a friend’s home (14% vs 4%), pointing to NFL viewing in Great Britain being more of a social novelty than a household tradition.

Motivations for watching also differ between markets. In Great Britain, the decision to watch is driven just as much by convenience and social context as by the games themselves. The two biggest influencers are watching with friends or family (45%) and the games’ availability on TV or streaming (45%). Football-specific factors sit notably lower, with 27% citing the teams involved and 25% pointing to game competitiveness.

In the U.S., the hierarchy shifts. Watching with friends or family matters most (52%), but the actual matchup is far more influential: 42% say the teams playing affect their decision – a 15-point gap compared with Great Britain. That gap suggests US audiences are more likely to approach Christmas games as “must-watch” fixtures depending on the matchup, rather than just something they’ll dip into if it happens to fit the day.

Halftime entertainment plays a much bigger role in Great Britain than in the U.S., with 21% of Britons saying it influences their decision to watch compared with just 12% of Americans. This gap suggests that in Britain, NFL Christmas games are competing more directly with a wider range of holiday entertainment – making the spectacle around the game an important lever for attracting more casual viewers. In the U.S., where the NFL is already deeply embedded in holiday traditions, halftime shows simply matter less in the decision to tune in, as the games themselves remain the primary draw.

But there can often be a gap between what audiences claim and how they behave. In Britain, despite Snoop Dogg headlining the halftime show for Detroit Lions vs Minnesota Vikings, the game drew 625,298 British viewers on Netflix – notably lower than the 707,635 who tuned in for Dallas Cowboys vs Washington Commanders, which did not feature the same level of halftime star power. This is according to Netflix viewership data provided by YouGov Behavioral.

On the other hand, Lions vs Vikings was the most popular game in the U.S., pulling 8.5% higher audience than the Cowboys vs Commanders game. The Lions vs Vikings matchup drawing higher viewership suggests that the halftime show may have had an impact – especially considering that the Cowboys vs Commanders game involved more widely supported teams. YouGov Profiles shows that 19% of NFL fans in the U.S. back either the Cowboys or Commanders, compared to just 13% for the Lions or Vikings.

It’s worth noting that year-on-year (YoY) Netflix audiences were down across all markets, with an overall decline globally of approximately 13.2%. The biggest proportional drops were as follows: Canada -59.7% and Great Britain -42.3%. Some of this could be because Netflix shared Christmas Day streaming honors with Amazon Prime in 2025 but was the sole streamer for the Christmas Day games in 2024.

Brand Exposure surges despite audience declines

Even with year-over-year audience declines across Netflix’s Christmas Day games – and with halftime performances not delivering the same lift seen previously – brand exposure on Netflix broadcasts improved significantly. In 2024, Netflix received 7 minutes and 23 seconds of exposure per hour during Ravens vs Texans and 12 minutes and 3 seconds during Chiefs vs Steelers. In 2025, exposure increased by more than 400%, rising to 40 minutes and 30 seconds per hour in Cowboys vs Commanders and 40 minutes and 41 seconds in Lions vs Vikings.

This substantial jump reflects both an expansion and evolution in Netflix’s asset strategy. The number of branded assets grew from 12 in 2024 to 15 in 2025, with six entirely new placements – including Giant Screen branding, Grandstand executions, and visibility on spectator merchandise and player robes.

Meanwhile, nine assets were carried over from the previous year but were enhanced through small, high-impact adjustments. Studio branding illustrates this well: In 2024, Netflix used a single large, centrally placed logo. In 2025, the brand increased the number of on-screen iterations and extended their time in shot. Although these assets occasionally shared space with Google branding, the overall approach allowed Netflix to occupy more total screen real estate and remain visible even during presenter close-ups. This example is showcased in the image below.

Netflix’s studio branding alone accounted for 11.4% of total broadcast time, compared with just 0.6% in 2024. As a result, the value delivered through this asset rose dramatically, underscoring how strategic placement, asset variety, and on-screen duration can materially improve brand impact – even in a year when overall viewership softens.

Across the brands tracked during the 2025 Christmas Day matches, Netflix was the strongest performer under YouGov Sport’s BIS-X methodology, which measures the additional Net Sponsorship Value a brand earns through the combination of its on-screen presence and its underlying brand health and resonance.

Netflix scored consistently well across all six brand health metrics – Buzz, Impression, Reputation, Quality, Value and Satisfaction – which collectively contributed an additional 5.6% uplift in sponsorship value. This holds true even when we take into account the decrease in its Buzz scores based on YouGov BrandIndex data that occurred in the week of the Christmas matches.

By comparison, the NFL itself saw a notable rise in Buzz driven by Game Day spotlight, resulting in a 1.4% boost to its Net Sponsorship Value, shown in the graph below. However, lower consumer ratings on the Value metric limited the league’s ability to generate further gains.

In addition, Netflix performed strongly across brand recall. YouGov assesses memorability across nine recall drivers, including the use of eye-catching imagery, clarity and ease of understanding, and the likelihood of appearing repeatedly through replays and varied asset placements. Netflix’s breadth of assets across the broadcast meant the brand was consistently visible in multiple contexts, supporting stronger recall outcomes.

When brand visibility, perception, recall, and on-screen duration are considered together, Netflix’s sponsorship delivered 67% of the maximum available advertising value during the Cowboys vs Commanders match and 61% during Lions vs Vikings. In both games, Netflix's strong and positive brand perception contributed 5.63% of the total value, while brand resonance during gameplay added a further 8.00%, underlining how both presence and perception combined to drive sponsorship performance.

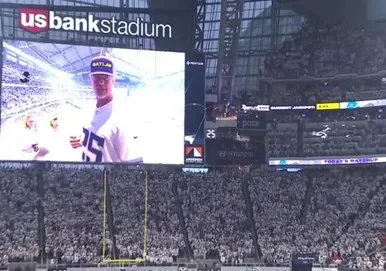

For similar reasons, U.S. Bank also benefited from YouGov’s brand recall assessment. As the title sponsor of the Vikings' stadium, the brand received repeated verbal mentions and appeared consistently through permanent in-stadia features across multiple broadcast assets (as showcased in the image below). This helped to embed the brand’s name in the viewers’ memories. Additionally, U.S. Bank’s underlying brand perception was broadly in line with other prominent sponsors present during the matches – such as Netflix, Tide, and Sony – this meant it generated a more modest uplift from this valuation factor, delivering a +1.15% intangible value boost.

Focusing on 3M’s branding, the data highlights clear opportunities to strengthen impact. In particular, building a stronger and more explicit connection between the brand and the event itself could help lift Buzz scores – an area that, if fully maximized, has the potential to unlock up to an additional 5% in sponsorship value.

3M received limited on-screen exposure from its Giant Screen and Grandstand assets, accounting for just 1% of total broadcast time, largely due to tight camera angles and sideline congestion restricting visibility. Of its placements, Grandstand branding performed best, achieving a brand impact score of 2.43 out of 5 thanks to moments of on-screen centrality and clear sizing. The image below showcases an example of 3M's Grandstand branding.

To improve effectiveness, 3M could make better use of existing space – for example, by introducing a stronger message within logo white space – while improved lighting on upper-level Grandstand signage could further enhance visibility and brand recall.

These examples only scratch the surface of what can be uncovered through deeper sponsorship analysis. Beyond visibility and recall, YouGov is also able to assess the return on investment for each brand involved in the Christmas Day matches – helping sponsors understand not just where they appeared, but the value generated from that presence.

Streaming wins over viewers in Great Britain, but divides US audiences

While the shift to streaming has expanded the NFL’s reach and sponsor exposure across new platforms, audience attitudes toward this move vary sharply by market. In Great Britain, views on streaming are closely tied to engagement. Among those who watch an NFL game on Christmas Day, 70% see the league’s move to streaming as positive. Among non-viewers, sentiment is far weaker: Just 10% view the shift positively, compared with 17% who see it negatively – with the majority (72%) remaining neutral. This suggests that streaming is welcomed by those already inclined to watch but has yet to meaningfully change perceptions among the broader British audience.

In the U.S., reactions are more polarized; just 28% of viewers describe the move to streaming as positive, while 46% say it is negative. While streaming increases platform reach and commercial opportunity, it can also introduce friction in a market where fans are accustomed to finding NFL games easily on traditional broadcast TV. For some American viewers, access – rather than availability – remains a sticking point.

In spite of the polarization in attitudes towards the shift to streaming, there are positive signs with respect to how sports streaming can boost platforms like Netflix. YouGov Behavioral data tells us that Netflix USA likely benefitted from an increase in subscribers because of the games being shown on the platform. Behavioral's "Converted to Platform" metric is an estimation of the number of people that may have signed up to the platform to watch the title, based on the first title they viewed after signing up. This figure for the NFL Christmas day games was 139k in the U.S., while in the UK it stood at 24.4k.