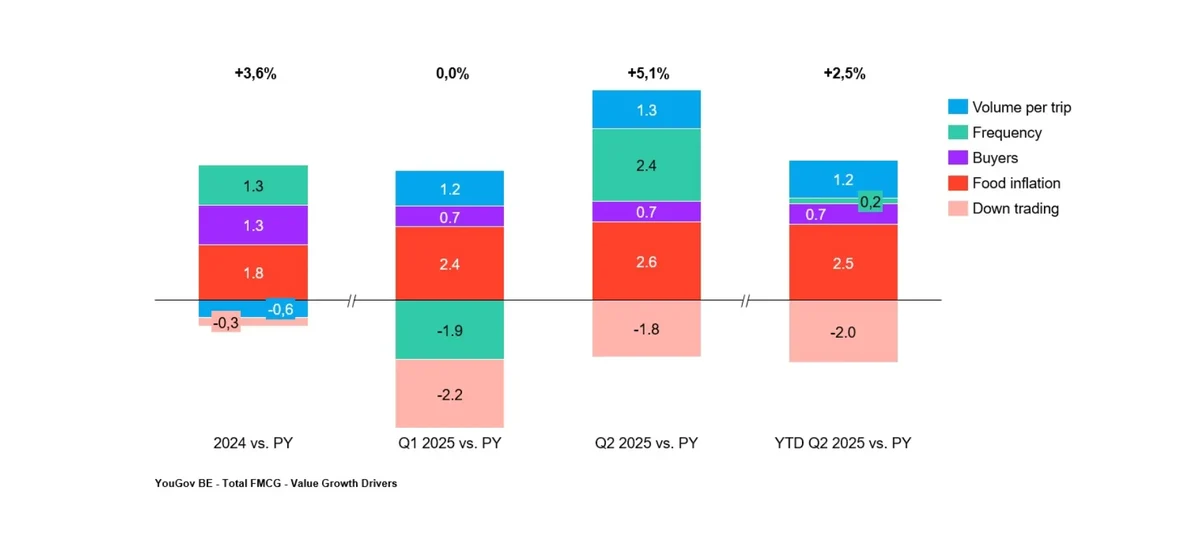

Following a flat Q1, Q2 2025 delivered an impressive +5% growth. This article explores the key drivers behind this notable, yet anticipated, shift in momentum.

KPIs

While most KPIs mirrored Q1 trends, increased shopping frequency stood out as the key driver of the turnaround. Additionally, volume per trip saw a slight increase, population growth continued, and food inflation remained high.

Downtrading is the only KPI evolving negatively, but A-brands are successfully defending their market share through intensified promotional efforts.

External factors

As discussed in the previous newsletter, Q1 was impacted by a negative calendar effect, reducing shopping occasions. These effects faded in Q2, with Easter falling in April and more Sunday openings boosting shopping frequency. Additionally, favourable weather conditions (warm, dry, and sunny) drove strong growth in Fresh Food and Beverages.

Retail Channels

After years of decline, E-commerce and Specialty Stores emerged as the top performers in Q2 and S1 2025. E-commerce growth was fueled by pure online players (e.g., Bol, Amazon) and a rebound in brick-and-click formats.

On the downside, hypermarkets continue to decline and with the sale of Cora, additional opportunities are emerging for other channels to capture growth.

Looking forward

With Q2’s strong performance being largely calculated, what lies ahead for the rest of the year? We anticipate a more moderate growth of around +2-3%, primarily driven by food inflation and increased shopping occasions. The resurgence of e-commerce is a trend to watch closely, as it could significantly reshape shopper behaviour and retail dynamics.