APAC Biggest Brand Movers highlights the ten brands that have registered the most statistically significant month-on-month upticks in consumer perception metrics across a selection of Asia-Pacific markets. These rankings identify the brands which have logged the greatest number of improvements across 13 metrics each month – ranging from aided brand awareness and corporate reputation, to purchase consideration and customer satisfaction. The data is taken from YouGov BrandIndex, a syndicated brand tracker which continuously collects data on thousands of brands around the globe every day.

Australia: Nanna’s tops the chart

Nanna’s takes the top position in Australia as the Biggest Brand Mover for November, after posting improvements across three brand perception metrics: Value, Recommendation, and Quality. The brand also recorded an uplift in Consideration from the purchase-funnel metrics.

Peroni comes second, with increase in Corporate Reputation, Recommendation, Purchase Intent, and Current Customer.

In third, YouTube registers improvements in Ad Awareness, WOM Exposure, as well as uplift in Customer satisfaction. Booking.com takes fourth with improvements in Buzz, Value, and Recommendation.

Rounding out the top five, Microsoft posts gains in Value, Recommendation and Consideration.

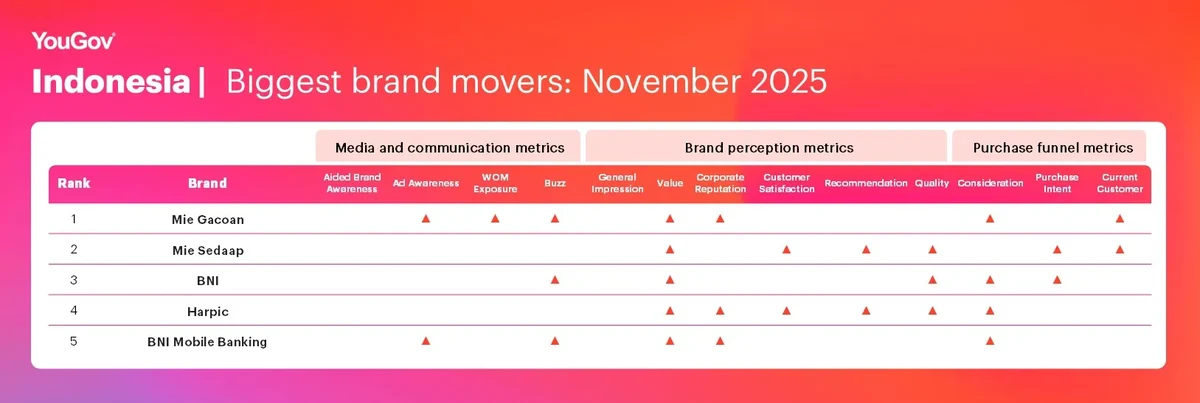

Indonesia: Mie Gacoan rises to the top

Mie Gacoan takes the top position in Indonesia for November as the Biggest Brand Mover, posting improvements in eight out of thirteen metrics: Ad Awareness, WOM Exposure, Buzz, Value, Corporate Reputation, Consideration, and Current Customer.

In second place, Mie Sedaap records gain across Value, Customer Satisfaction, Recommendation, Quality, Purchase Intent, and Current Customer.

BNI comes in third after registering uplift in Buzz, Value, Quality, Consideration, and Purchase Intent.

In fourth, Harpic shows improvements across five of the six brand perception metrics: Value, Corporate Reputation, Customer Satisfaction, Recommendation, and Quality, alongside an uplift in Consideration.

Rounding out the top five, BNI Mobile Banking posts increases in Ad Awareness, Buzz, Value, Corporate Reputation, and Consideration.

Malaysia: Xiaomi claims the top spot in November

In Malaysia, Xiaomi takes the top spot for November with gains across WOM Exposure, Buzz, General Impression, Value, Customer Satisfaction, Recommendation, Consideration, and Purchase Intent.

In second place, Setel records uplifts in Ad Awareness, WOM Exposure, Buzz, Value, Recommendation, and Consideration.

Head & Shoulders ranks third, registering increases in Ad Awareness, WOM Exposure, Purchase Intent, and Current Customer.

In fourth, AirAsiaGo sees improvements in Corporate Reputation, Quality, Consideration, and Purchase Intent, though the brand recorded a decline in Buzz.

Apple Watch closes the top five with improvements in four brand perception metrics: General Impression, Value, Corporate Reputation, and Quality.

Thailand: Rejoice delivers a near clean sweep in November

Rejoice emerges as Thailand’s Biggest Brand Mover for November after registering gains across 12 of the 13 metrics: Ad Awareness, WOM Exposure, Buzz, General Impression, Value, Corporate Reputation, Customer Satisfaction, Recommendation, and Quality, extended into the purchase funnel metrics, with improvements in Consideration, Purchase Intent, and Current Customer.

Not far behind, Maybelline posted improvements across 11 out of 13 metrics including Ad Awareness, WOM Exposure, and Buzz, as well as across General Impression, Value, Corporate Reputation, Customer Satisfaction, Recommendation, and Quality, Consideration and Purchase Intent.

Nestlé takes third place after logging uplifts in Buzz, General Impression, Customer Satisfaction, Recommendation, Quality, Consideration, and Purchase Intent.

Kasikorn follows, with gains recorded in WOM Exposure, Buzz, General Impression, Corporate Reputation, Customer Satisfaction, Recommendation, and Purchase Intent.

Rounding out the top five, Colgate Plax shows improvement across five of the six brand perception metrics: Corporate Reputation, Customer Satisfaction, Recommendation, Quality, and Value, alongside an uplift in Ad Awareness.

Wonder who are the Biggest Brand Movers in other APAC markets – including China, Japan, Philippines and Vietnam? Contact us and sign up for a free brand health check today!

Methodology

Biggest Brand Movers for November 2025 ranked brands according to the number of statistically significant score increases they achieved across the following BrandIndex metrics, between October and November 2025.

Media and Communication Metrics

- Aided Brand Awareness – Whether or not a consumer has ever heard of a brand

- Ad Awareness – Whether a consumer has seen or heard an advertisement for a brand in the past two weeks

- Word of Mouth Exposure – Whether a consumer has talked about a brand with family or friends in the past two weeks

- Buzz – Whether a consumer has heard anything positive or negative about a brand in the past two weeks (net score)

Brand Perception Metrics

- General Impression – Whether a consumer has a positive or negative impression of a brand

- Customer Satisfaction – Whether a consumer is currently a satisfied or dissatisfied customer of a particular brand

- Quality – Whether a consumer considers a brand to represent good or poor quality

- Value – Whether a consumer considers a brand to represent good or poor value for money

- Recommendation – Whether a consumer would recommend a brand to a friend or colleague or not

- Corporate Reputation – Whether a consumer would be proud or embarrassed to work for a particular brand

Purchase Funnel Metrics

- Consideration – Whether a consumer would consider a brand or not the next time they are in the market for a particular product

- Purchase Intent – Whether a consumer would be most likely or unlikely to purchase a specific product

- Current Customer – Whether a consumer has purchased a given product or not within a specified period of time