The use of weight-loss medicine has accelerated globally – and the Nordic markets stand out as European frontrunners. Denmark and Sweden lead in both awareness and use of GLP-1 treatments such as Ozempic and Wegovy.

85% of Danes and 70% of Swedes have heard of weight loss medications – well above the EU average of 57.9%. The Nordics also rank among the top for use and consideration, with 9.1% of Danish and 7.5% of Swedish households currently using a GLP-1 medication, and a further 13–15% open to future use. Only Italy comes close, with a slightly higher user share.

Consumers in Denmark and Sweden approach these innovations with characteristic pragmatism – seeing them less as shortcuts and more as tools to complement existing routines built on healthy habits, regularity, and balance.

Diet and discipline

With GLP-1 treatments reducing appetite, users are encouraged to make every meal count – focusing on whole, nutrient-dense foods rich in protein, fiber, and healthy fats.

Many Danish and Swedish consumers already share some of these dietary principles, though their habits differ in key areas:

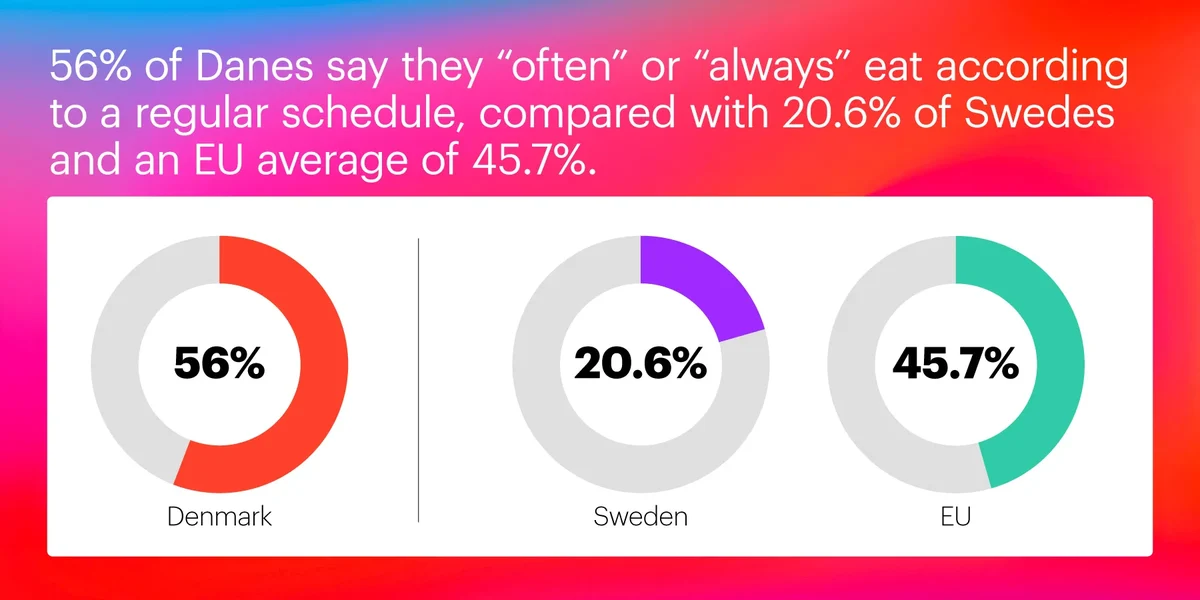

- 56% of Danes say they “often” or “always” eat according to a regular schedule, compared with 20.6% of Swedes and an EU average of 45.7%.

- When it comes to sugar preferences, 19.5% of Danes prefer zero- or low-calorie sweeteners, compared to 12.7% of Swedes and an EU average of 11.5%.

- Both markets are less likely than the EU average to avoid artificial sweeteners, reflecting a pragmatic acceptance of functional or reformulated products that support calorie control.

Daily movement is also a hallmark of the Nordic lifestyle: 59% of Danes and 55% of Swedes stay active every day, both ahead of the EU average of 54%. Rather than simply smoothing the integration of GLP-1 treatments, this structured, active approach highlights a clear divide - between those who proactively maintain daily healthy habits and those who turn to medical support to help establish or reinforce such routines.

Supplements: Go or no-go?

Despite a growing use of weight-loss medicine, Danes and Swedes remain highly selective about supplements and functional foods. Only 4–6% see high-protein products such as snacks or shakes as a good investment, while 40–47% consider them a waste of money – indicating scepticism toward processed “fitness” foods.

Collagen and probiotic supplements face even greater hesitation, while multivitamins enjoy moderate trust, particularly in Denmark, where nearly 30% view them as beneficial. Views on immunity-boosting supplements diverge sharply: Danish consumers are relatively positive, while Swedish consumers show some of the highest hesitation levels seen across the European market.

“Consumers don’t necessarily want to replace nutritious food with supplements. In some areas, they want fewer choices – but the right ones. In others, they want the freedom to take a clear stand for themselves,” says Charlotte Alring, Commercial Director, YouGov Sweden. “For brands and retailers, understanding this balance is crucial in a fast-changing market where weight-loss medicines are reshaping how we consume.”

These differences highlight how cultural attitudes toward supplements vary widely within Europe – and how this variation affects both GLP-1 users and those who pursue weight management through more traditional lifestyle changes.

A Nordic approach to wellbeing

The growing interest in Ozempic and other GLP-1 products in Denmark and Sweden amongst topics as health and wellbeing reflects a new phase of self-management – one rooted in structure, moderation, and credibility. These are consumers who view health as an ongoing practice, not a project, and who remain selective about the tools and products that earn their trust.

For a deeper understanding of these trends and actionable insights to guide your strategy, explore our full Who Cares? Who Does? reports – 2025 edition and our Trend Reality report.