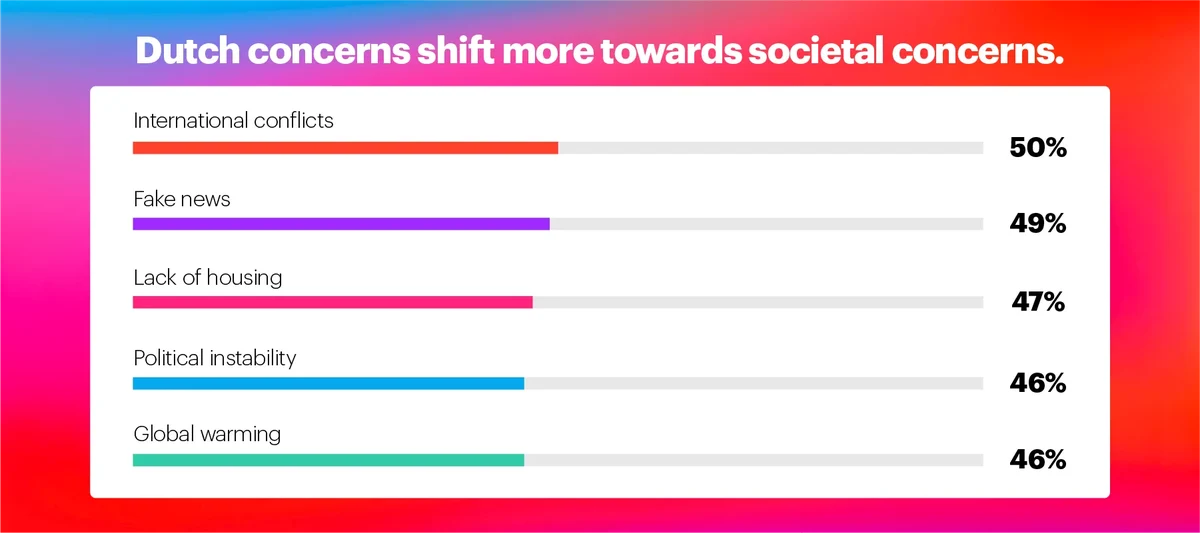

For Dutch consumers, sustainability has always mattered, and it continues to do so amid broader concerns. Dutch households rank international conflicts, fake news, housing shortages, and political instability among their top concerns ahead of climate change, which sits at number five. This mix of societal concerns is reshaping consumer priorities. And the recent repeat political elections, triggered by the failure to form a government, reflect broader instability.

Despite growing societal concerns, Dutch consumers continue to show strong engagement with sustainability in their daily lives. For example, almost 1 in 3 Dutch shoppers is an Eco-active (NL= 31%, EU = 25%, World= 23%). These shoppers feel a personal responsibility to reduce waste, actively seek out sustainable products, and are willing to pay more for it. Moreover, their total FMCG spend is estimated at more than €10 billion, making them a commercially valuable group.

What’s more, many sustainable behaviors are now mainstream, extending well beyond the Eco-Active group. For example, 96% of Dutch shoppers bring their own bags to the supermarket, 82% use refillable drinking bottles, and 65% choose products with ingredients from sustainable sources. These habits are not niche, they’re part of everyday life.

Even with strong engagement and ingrained habits, not every Dutch shopper finds it easy to act sustainably all the time. The value-action gap, consumers who want to shop sustainably but struggle to do so, now affects over 1 in 4 households. The reasons are clear but solvable:

- Economic pressure and price sensitivity: One in five Dutch households say it has become harder to act sustainably due to the current economic climate, making affordability a critical lever for brands.

- Declining eco-confidence: Only four in ten households feel their choices can make a real difference. While this is still higher than two years ago, confidence has slipped compared to last year, signaling the need for reassurance and empowerment.

- Trust deficit: Nearly 60% believe sustainability claims are marketing-driven, underlining the importance of transparency and proof of impact.

Implications for FMCG brands: Turning barriers into opportunities

For brands, these barriers are not roadblocks: they are clear opportunities to lead. Dutch consumers want sustainability to be credible, accessible, and practical, and brands that deliver on these expectations are already winning:

- Take local example: Kipster, which has redefined egg production through carbon-neutral farming, radical animal welfare, and livestreamed transparency. This approach resonates deeply with Eco-Actives, driving a value index of 141 and 38% value growth of all shoppers.

- Similarly, Gijs, a collective of over 80 local producers, champions regional sourcing and authenticity, achieving a value index of 130 and 10% penetration growth among Eco-Actives.

These examples prove that trust and relevance are the new differentiators. Brands that combine transparency with tangible benefits, such as affordability and convenience, can bridge the value-action gap and capture a growing share of sustainable spend.

The Who Cares? Who Does? 2025 report offers a complete view of Dutch consumer priorities, behaviors, and actionable insights for brands. From segment profiles to best practices, it’s your roadmap to winning with sustainability in a complex market.