Prices, Inflation and Loyalty

Discussions around prices have long dominated public discourse in Croatia. The introduction of the euro, rising costs, and the recently announced gradual phase-out of government subsidies for energy are expected to further intensify these debates. A hot autumn lies ahead—not in terms of weather, but in the form of heated public discussions and economic developments that will keep pricing issues in the spotlight.

Preliminary estimates for September show that the average annual inflation rate across the eurozone stands at 2.2%, while in Croatia it is twice as high, placing the country among the top three in terms of inflation, alongside Estonia and Slovakia.

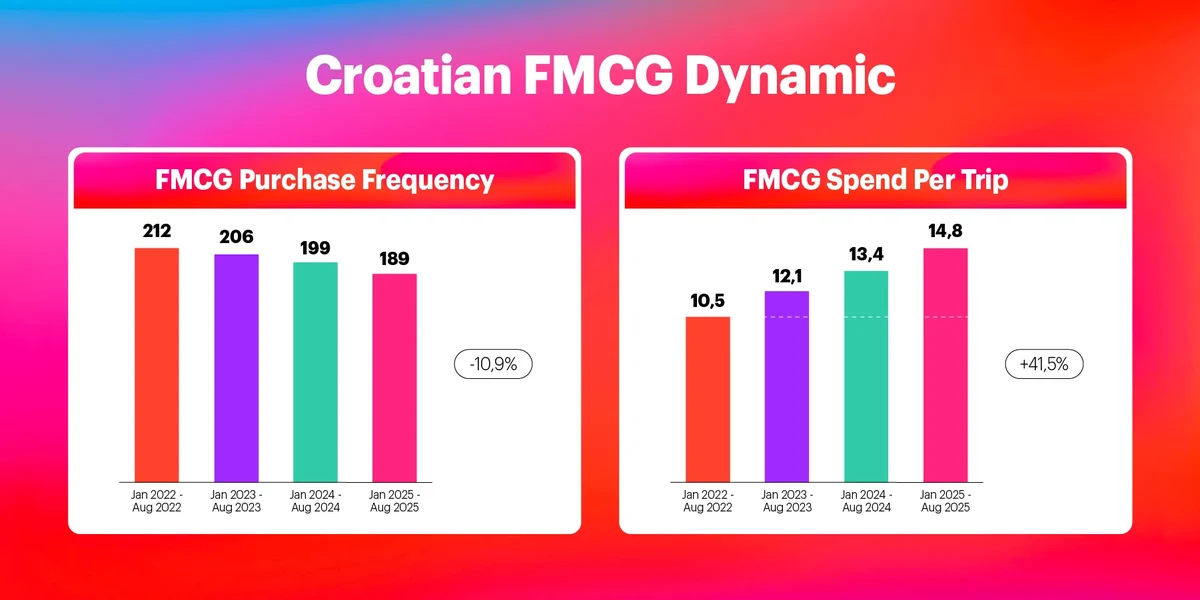

According to YouGov Shopper data, Croatian consumers spent 5% more on fast-moving consumer goods (FMCG) in the first eight months of 2025 compared to the same period in 2024, and 26% more than in 2022.

At the same time, shopping frequency has dropped to its lowest level. On average, shoppers made 189 trips in the first eight months of 2025, with an average FMCG basket value of €14.80—an 11% increase from 2024. and a striking 42% more than in 2022.

When it comes to Private Labels, Croatian households allocated one-third of their total packaged FMCG spending to these products between January and August 2025. This share has remained relatively stable over the past few years.

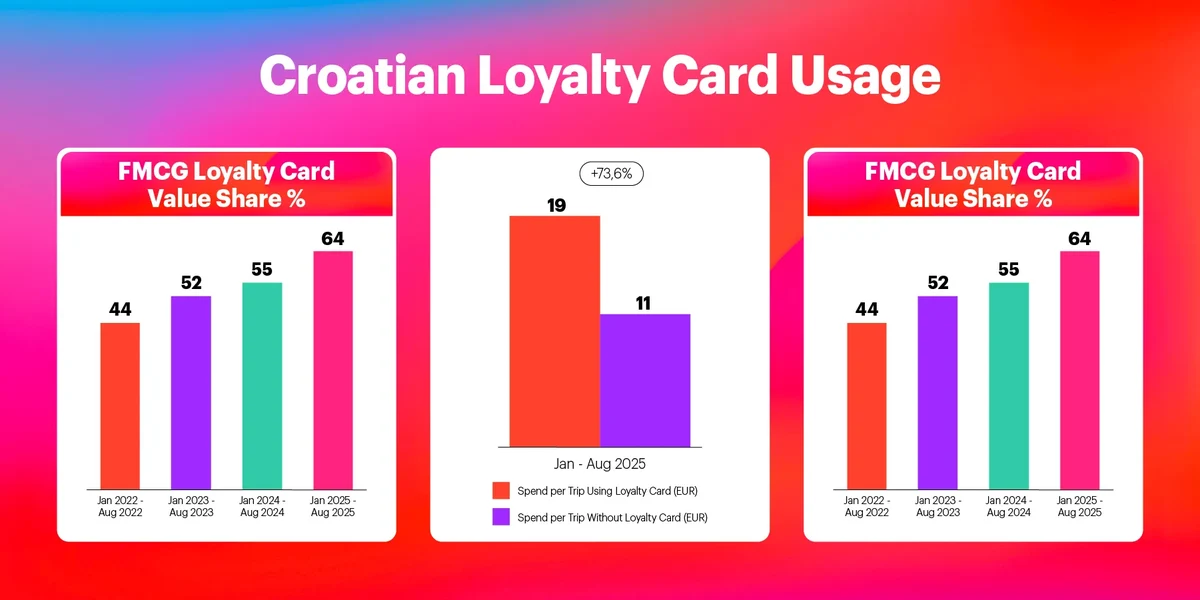

Loyalty cards continue to perform strongly, both in terms of adoption and usage intensity. Over 98% of Croatian shoppers used a loyalty card at least once during the first eight months of 2025. Loyalty cards were used in 50% of all purchases, and even more when measured by value. Notably, when a loyalty card is used, the average spend per trip is 74% higher compared to trips without one.

In an economic environment marked by high inflation and increasing pressure on household budgets, loyalty programs are becoming an essential tool for retailers. They play a crucial role in attracting and retaining shoppers—especially at a time when consumers are scrutinizing every purchase and seeking the best value for money.

Given the dynamic nature of the Croatian market, with Plodine and Spar launching their own loyalty apps in the first half of 2025., we are initiating a syndicated study to assess their performance, understand how competitors are responding, and explore the broader impact on shopper behavior. We look forward to sharing more insights in the coming months.

Methodology: YouGov Shopper Croatia is based on continuously collected data and rolling surveys on 1,500 households representative for the total population of the country.

YouGov Shopper offers access to a wealth of expertise and quality consumer panel data. We help the world’s most recognized FMCG & Retail brands to deliver superior customer experiences at every stage of the shopper journey. Learn more about YouGov Shopper.