Belgian shoppers are increasingly aware of environmental challenges, with climate change (43%), food waste (42%), and plastic use (37%) ranking among their top concerns. While their overall sense of urgency around sustainability appears slightly lower than the global average, this reflects a pragmatic and locally rooted mindset: one that favors realistic, actionable change over sweeping declarations.

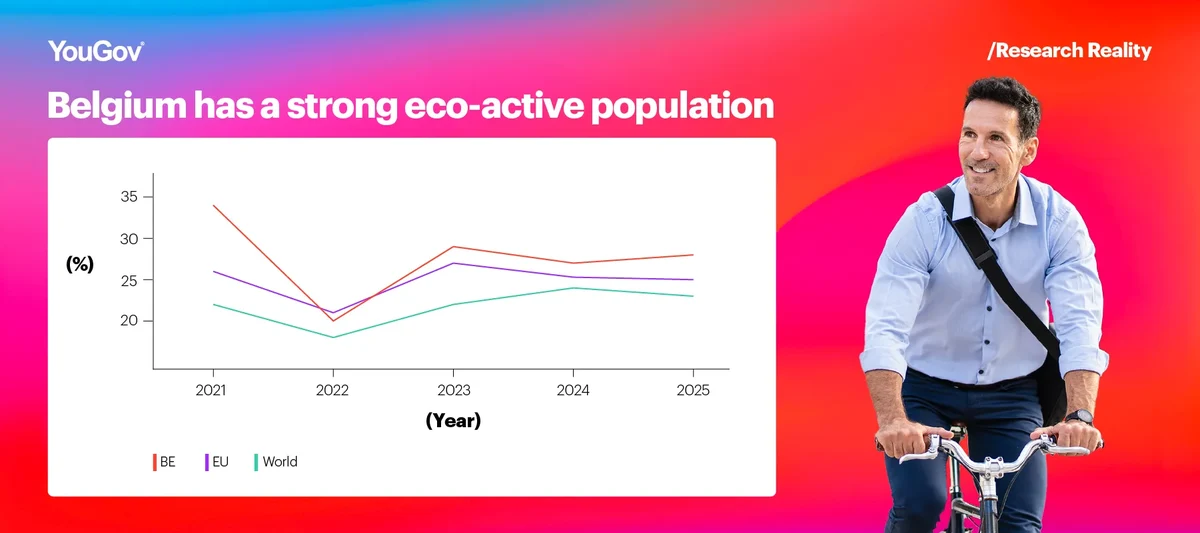

At the core of Belgium’s sustainability landscape is a key shopper segment: Eco-Actives. This group consistently engages in sustainable behaviors at levels above the global average, forming a stable and motivated base that makes its values count at the checkout:

- 48% of Eco-Actives purchase plant-based beverages, compared to just 34% of Eco-Dismissers.

- Fairebel, a locally rooted brand, is bought twice as often by Eco-Actives, who spend an average of €36 per household, versus €15 among dismissers.

- A similar trend appears with Garden Gourmet, where Eco-Actives have a fair share index of 145, indicating they are significantly overrepresented in the brand’s turnover.

These figures highlight that Eco-Actives are not only vocal about sustainability, they also actively support brands that align with their values, making them a powerful force for change in the Belgian FMCG market.

This sustainable mindset extends beyond Eco-Actives and into the broader population. Belgian shoppers show a clear preference for locally sourced ingredients, locally owned companies, refillable packaging, and fully recyclable materials. They are also notably proactive in reducing plastic use: two-thirds of the population express high frustration with plastic waste and report above-average adoption of:

- Reusable bags for groceries (84%)

- Reusable nets/bags for fresh products (77%)

- Reusable cups for drinks (56%)

These behaviors reflect a willingness to act sustainably, especially when solutions are tangible, convenient, and locally relevant.

However, despite good intentions, more than one-third of Belgian households report that economic pressures make it harder to maintain eco-friendly habits. Affordability therefore remains a key barrier to wider adoption. Trust is another challenge: two in three Belgians believe most sustainability claims are merely marketing tactics. This skepticism underscores the importance for brands to communicate clearly, credibly, and transparently.

Implications for FMCG brands in Belgium

To resonate with Belgian consumers, especially Eco-Actives, brands should:

Highlight local sourcing and ownership

Belgian shoppers trust brands with strong local roots. Emphasize Belgian origin and community impact both on pack and in brand storytelling.

Make sustainable options financially accessible

Eco-Actives spend more when value is clear, but price remains a barrier for many. Offer value formats for plant-based products or refillable packaging to make eco-friendly choices more attainable.

Prioritize practical, everyday sustainability

Belgians adopt habits like using reusable bags (84%) and produce nets (77%) when solutions are simple and visible. Focus on packaging that is clearly recyclable or reusable, with straightforward instructions.

Communicate with clarity and proof

Two-thirds of Belgians distrust vague claims – “eco-friendly” isn’t enough. Use specific language like “100% recyclable, made from 85% recycled material”, backed by certifications or traceable data.

The Belgian FMCG landscape is not just ready for sustainable transformation, it’s already moving. Brands that align with consumer values and overcome barriers with authenticity and relevance will be best positioned to lead.

For a deeper understanding of these trends and actionable insights to guide your strategy, explore our full Who Cares? Who Does? Sustainability Report - 7th edition or watch our on-demand Webinar ‘Who Cares? Who Does?’ Sustainability.