Health stands out as one of the most influential concerns for Dutch consumers, alongside economic stability and global affairs (Trend Reality Report 2025). Yet in the Netherlands, health is never purely functional: pleasure and indulgence play a powerful role. Consumers seek products that combine wellbeing with enjoyment, reflecting a cultural preference for moderation over extremes.

The rise of Dutch health-actives

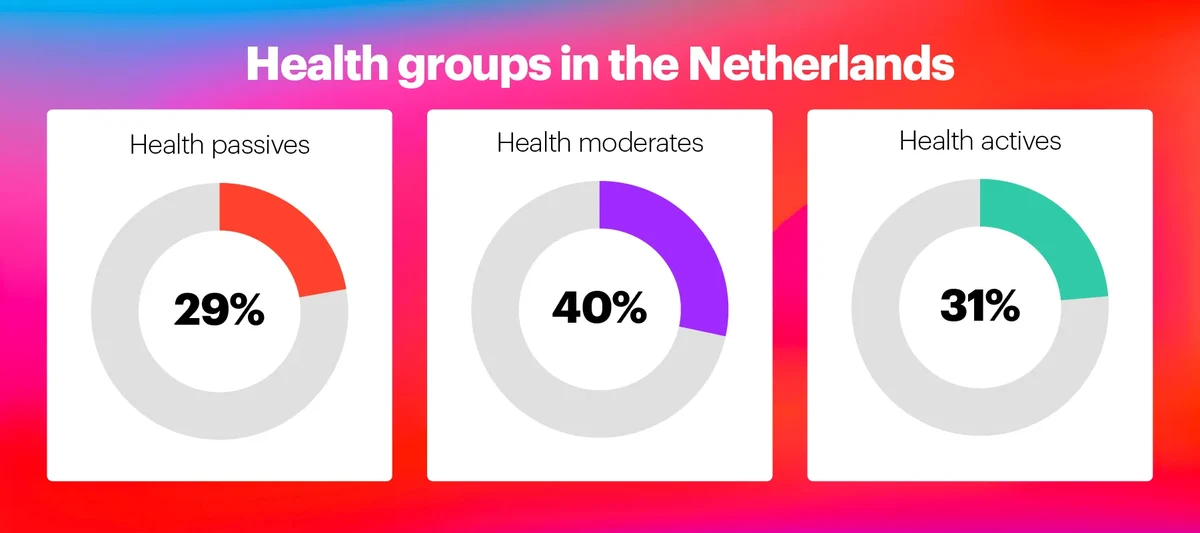

Dutch consumers aren’t just thinking about health, they’re living it. Over 30% of households qualify as health-actives and another 40% as health moderates, placing the Netherlands well above the EU average in proactive health behavior. These groups consistently follow a wide range of diet and lifestyle practices, from hydration and fresh food choices to regular movement and mental wellbeing. Their behavior signals a shift from intention to implementation: in the Netherlands, health is no longer aspirational; it’s operational.

Sugar reduction as a mainstream behavior

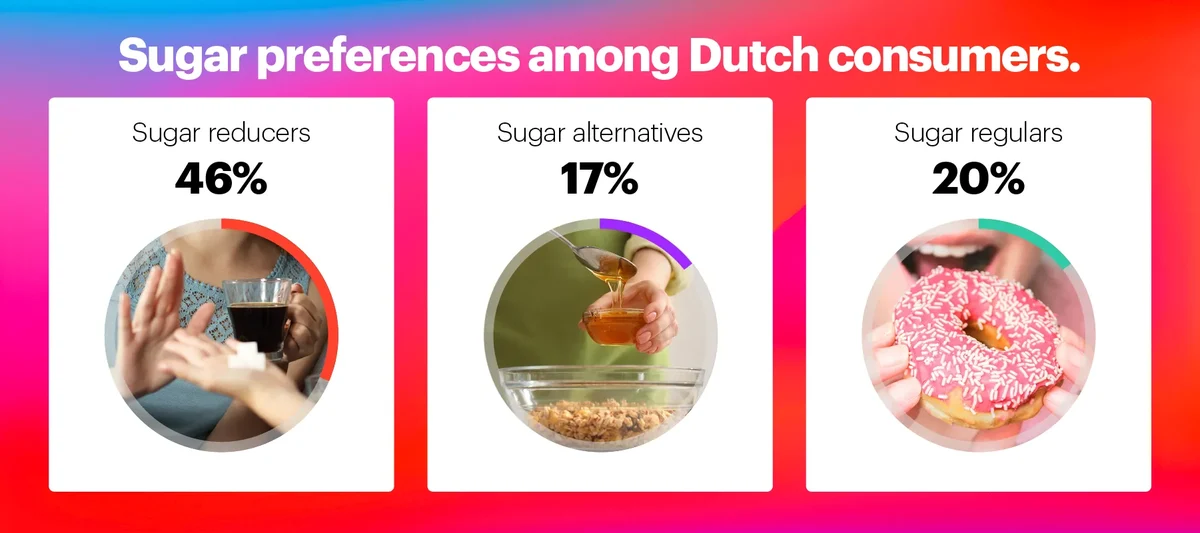

Within this health-conscious landscape, sugar reduction stands out as one of the most common behaviors. Nearly half of Dutch households actively identify as sugar reducers, and their preference for zero- or low-calorie sweeteners far exceeds global norms (17% vs. 11%, Who Cares? Who Does? Health 2025).

These choices translate into distinct purchasing patterns: sugar reducers lead in health-focused categories such as fresh fruit and plant-based dairy, where their value share surpasses 50%. They also allocate more to products perceived as natural or premium e.g. spending €105 per buyer on refrigerated yoghurt and €31–36 on plant-based dairy while maintaining strong penetration in everyday staples.

Broader healthy eating habits

These insights align with broader healthy dietary habits among Dutch households:

These patterns reflect a pragmatic approach to balanced nutrition. Future consumption plans confirm this trend, with over 1 in 3 shoppers planning to reduce sweets, ultra-processed foods, and salty snacks, while more than 10% of Dutch people want to increase their consumption of pulses and beans.

Emerging trend: Ozempic and GLP-1 awareness

GLP-1 weight-loss medication is rapidly gaining attention in the Netherlands. Awareness is exceptionally high: 77% of consumers know about GLP-1 treatments, and 62% specifically recognize Ozempic as a trend (Who Cares? Who Does? Health 2025, Trend Reality Report 2025). While usage remains niche (5% of households, with another 6% considering future use), these GLP-1 users represent a powerful segment, spending more than €1 billion annually on FMCG. Time will tell if this niche evolves into a mainstream trend, amplifying its already significant impact.

Implications for FMCG brands

Dutch consumers are increasingly taking charge of their health embracing sugar reduction, plant-based eating, and even advanced solutions. Yet, skepticism remains strong when it comes to paying for health products without clear benefits: 69% consider collagen supplements “a waste of money,” and that figure rises to 74% for CBD oil (Who Cares? Who Does? 2025). Even multivitamins and immunity supplements, which show the most potential, only convince a minority that they are a good health investment.

This underscores a key point: health claims alone aren’t enough. Products must deliver tangible, credible benefits, whether through reduced sugar, added nutrients, or gut-friendly and energy-boosting ingredients. GLP-1 adoption illustrates this mindset perfectly: consumers invest where results are proven, signaling a shift toward functional, evidence-based health solutions rather than superficial add-ons.

Ready to explore more about these FMCG trends?

For deeper insight into these behaviors and their implications for your strategy, explore:

- [Webinar] Trend Reality 2025 – where YouGov experts reveal the latest market trends and their real-world applications.

- [Webinar] ‘Who Cares? Who Does?’ Health – for the latest shopper behavior insights on health and well-being.