How far along are we with the protein shift from animal to plant-based products?

The recent introduction of hybrid products in the meat section by multiple retailers has once again highlighted that the gradual transition from animal to plant proteins should be encouraged for several reasons. This shift is beneficial for both our health and the environment. For example, the food triangle of the Flemish Institute for Healthy Living encourages the use of plant proteins instead of animal ones to reduce the risk of several diseases (coronary heart disease, strokes, intestinal cancers, and type 2 diabetes). A kilogram of animal protein also has a much larger environmental footprint, as it requires more land and water and generates more greenhouse gases and nitrogen emissions.

Awareness of the desirability of this change has been ongoing for some time. With the launch of Alpro in 1980, the shift in dairy accelerated. Tofu and tempeh also began to gain popularity around that time. In the 1990s, the first ready-made meat substitutes appeared in supermarkets, including vegetarian sausages, nuggets, schnitzels, and minced meat alternatives, often based on soy. But how far have we come in the meantime, two generations later, with these products, and are they still making progress?

Meat and plant-based alternatives:

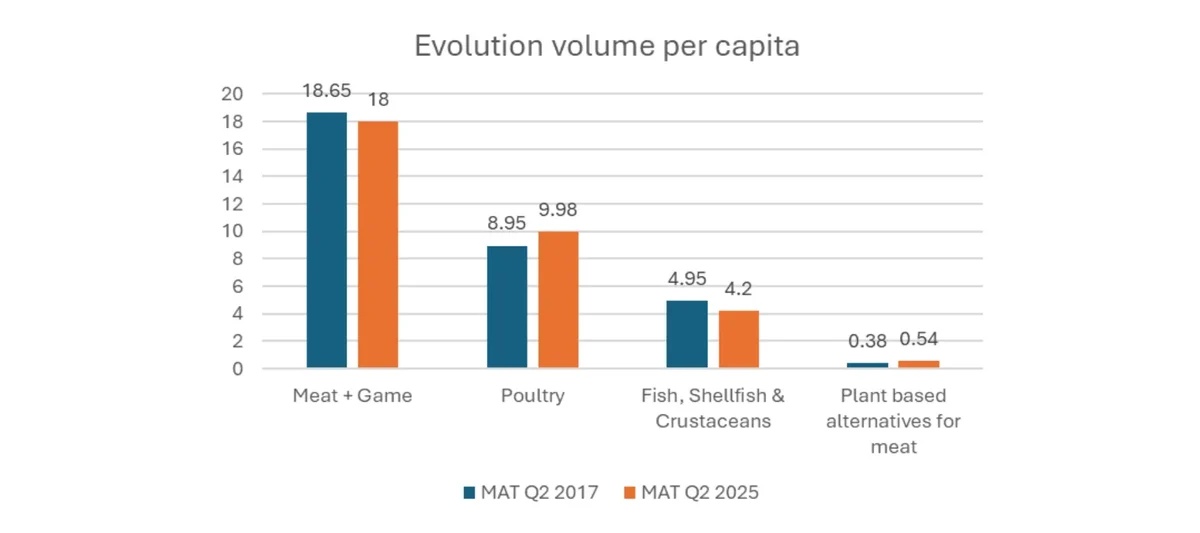

Since 2017 (our reference point due to the methodological change in 2022), there has been little change in the consumption quantities of meat and poultry for in home use: we lost one kilogram per person in meat (beef, pork, game, lamb, mixed meat, …), but this was more than compensated by the growth of poultry. The penetration of these product groups is not an absolute measure of the number of individual vegetarians, but still 98.6% of households buy them, and that remains stable. Where we do see a decline is in the purchase of fish, shellfish, and crustaceans for home consumption, but this seems to be driven more by the price increase (+32% for fish compared to +26% for meat and poultry), a few weaker mussel years, and changing taste preferences rather than by the protein shift.

In the same period, the penetration of plant-based alternatives for meat rose from 27% to 33%, and the average volume per capita grew by 42%, but the volumes clearly show that the importance remains very small, and that there is still a very long way to go.

Dairy and plant-based alternatives

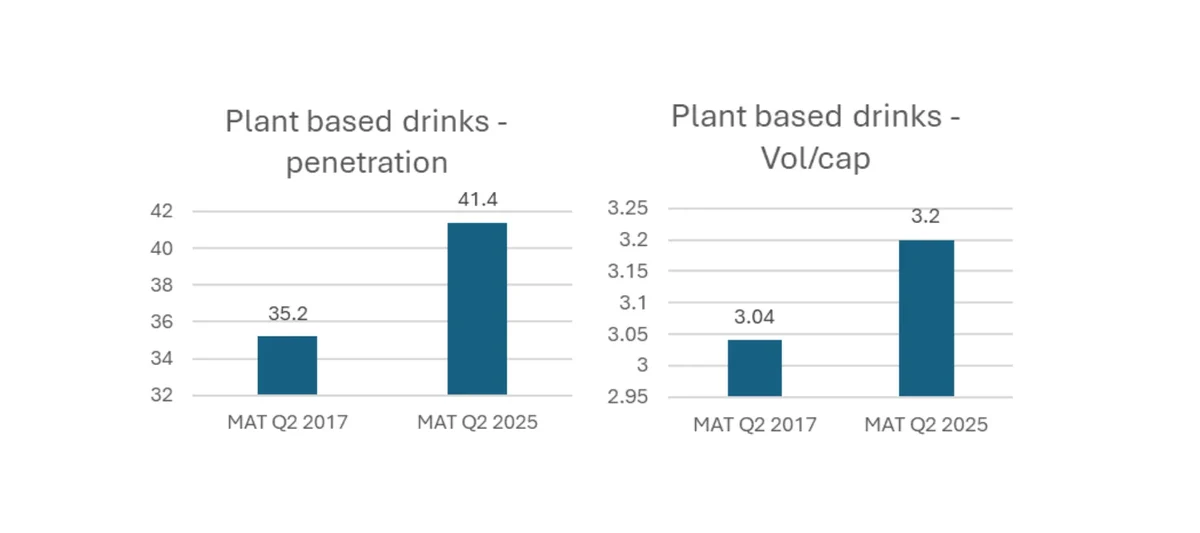

The plant-based drinks are still attracting new buyers, despite an already extensive history. However, volume growth is not proportional. The decline we see in consumption milk cannot therefore be attributed to the pressure from plant-based alternatives. That decline does mean, however, that these drinks have now risen to 8.3% of the volumes of consumption of milk.

We see more volume growth in plant-based alternatives to yogurt (+44%) and cream (+22%), but these segments do not prevent animal products from continuing to grow slightly.

Other product groups

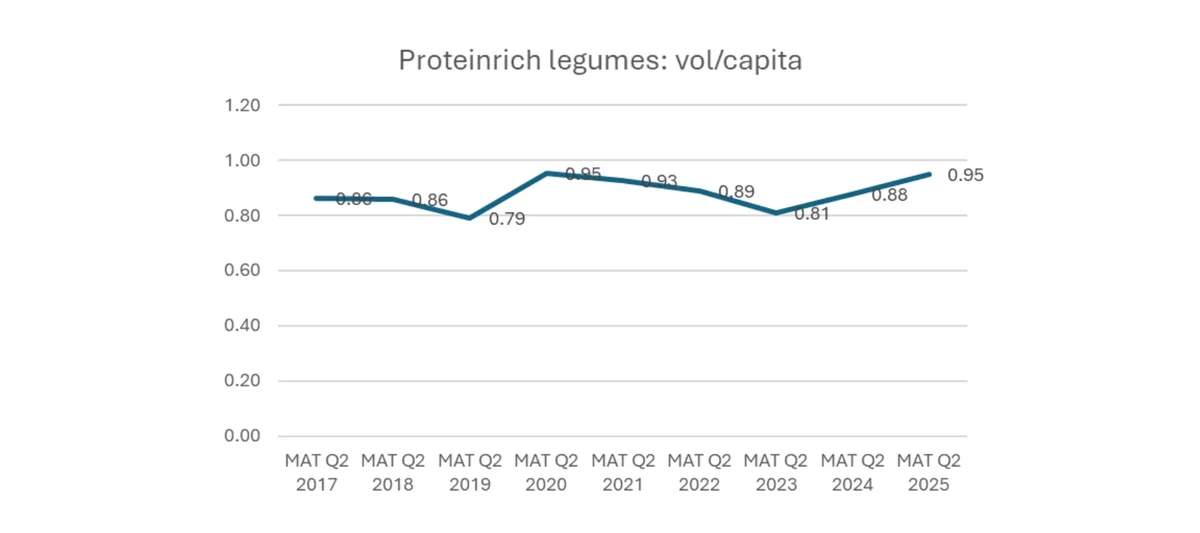

Some other products are also being looked at with interest, such as protein-rich legumes, which are promoted as meal components in vegetarian and especially vegan circles. They received a boost during the first year of the coronavirus, but have made no further progress since.

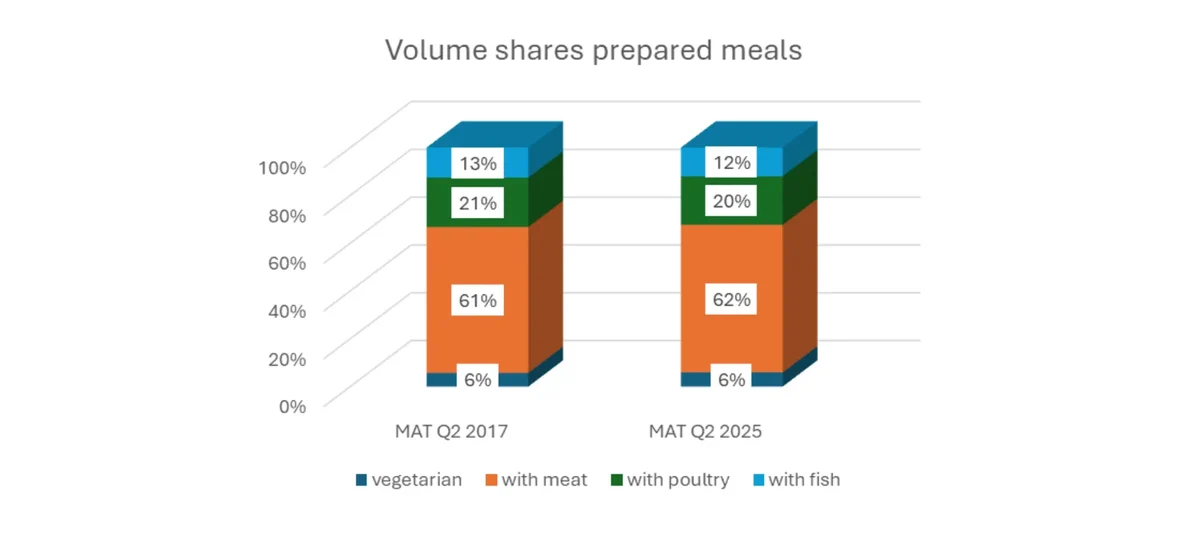

Within prepared meals (excluding pizza and quiche), we can distinguish between vegetarian meals and those with meat, poultry, or fish. Here too, there is clearly no decline in animal proteins.

Conclusion:

The protein shift has clearly not yet taken hold among the population. There are few or no indications that animal products are gradually being replaced by plant-based ones. Awareness around this appears to be very limited. Some alternatives are indeed showing growth, but in comparison to animal products they usually remain very small. We are curious whether hybrid meat alternatives will be able to bring about a change in this. To map this properly, we are already creating a new product category in our databases within YouGov.