The deposit return system in Poland.

This is a moment that may redefine the beverage market—not only operationally, but above all from the consumer perspective.

The system will cause an apparent increase in prices—because although a deposit is added, which is refunded when the packaging is returned, the mechanism itself may influence how prices are perceived. In practice, this means that consumers’ purchasing behaviors may differ from their declared intentions. For brands and manufacturers, the key will be to observe whether this change becomes a barrier or simply a new element of everyday habits.

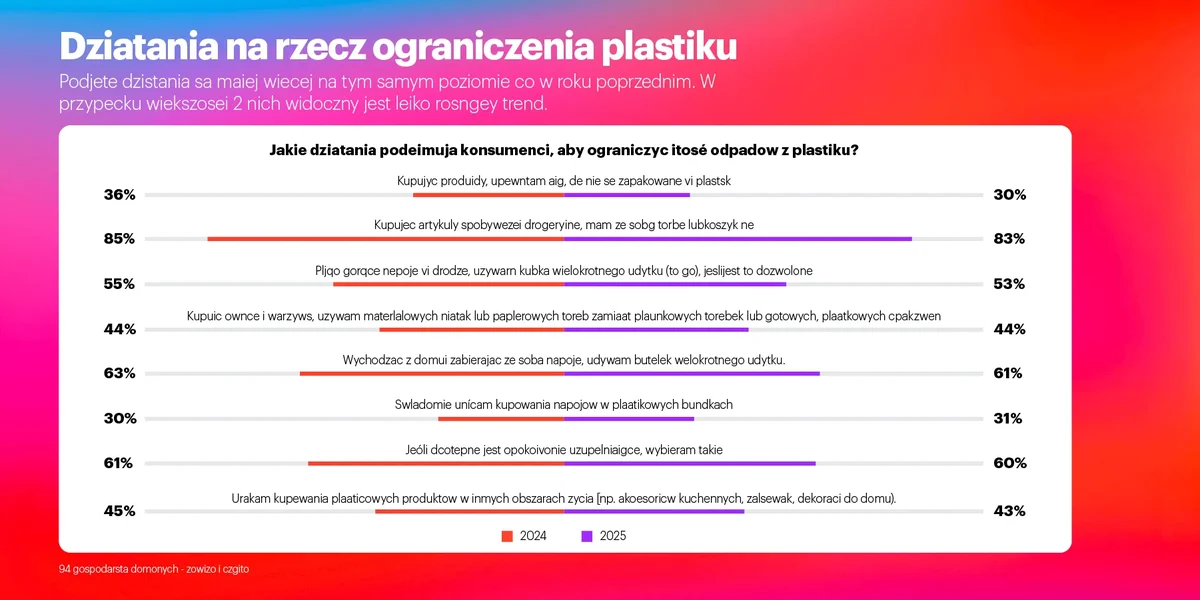

We can already see that Poles are increasingly engaging in pro-environmental actions, and the dynamics of these behaviors grow year by year. According to data from the “Who Cares? Who Does?” 2025 report, 86% use their own bags, 63% use reusable bottles, and 36% declare that when shopping, they pay attention to whether products are not packaged in plastic. The percentage of people who declare choosing products in refill packaging remains stable—currently at 61%. This is a positive signal that may translate into acceptance of the deposit system—provided the solutions are simple and intuitive for consumers.

However, the introduction of the deposit return system may affect how consumers put their pro-ecological intentions into practice. Therefore, it may bring various effects, such as:

• changing the channels and retailers where they have previously bought beverages;

• changes in packaging type and size, and in purchase frequency;

• buying cheaper products or private-label products;

• using tap water, filters, reusable containers, etc.;

• choosing alternative products without a deposit;

• using refill-type packaging that can be refilled;

• reduced interest in multipacks (multiple deposits).

To understand Shoppers’ reactions and the impact of the deposit system on their purchasing decisions, YouGov is launching a 3-wave syndicated project, DRS System, based on data from the Household Panel. The first measurements will begin in November 2025, with further waves planned for April and September 2026.

As part of the project, we will combine declarative data with actual purchasing behaviors by analyzing:

• actual household purchases in selected categories: carbonated soft drinks (CSD), water, juices and beverages, energy drinks;

• trends and the dynamics of changes in purchase structure, packaging types, and sales channels;

• flows between categories, brands, packaging types, and sizes—including Diagnostic Trees:

• changes in volumes (Gain & Loss) and the structure of buyers (New / Lost / Repeat).

Thanks to this, the DRS System will allow us to precisely determine how strong the impact of the deposit return system is on the market—who gains, who loses, and which brands adapt best to the new purchasing landscape.

We invite you to collaborate with us and follow our publications featuring the results of our report.