As consumers across Austria, Switzerland, and Germany plan their breaks, new data from YouGov’s Behavior Change report reveals a fascinating interplay of travel motivations, pragmatic budget considerations, and appreciation for local and home-based leisure. The way the DACH region approaches holidays is evolving, and so is holiday-related consumption behavior, offering important insights not only for businesses in the travel and hospitality sectors, but also for FMCG retailers and manufacturers.

Abroad still beckons, but home holds its charm

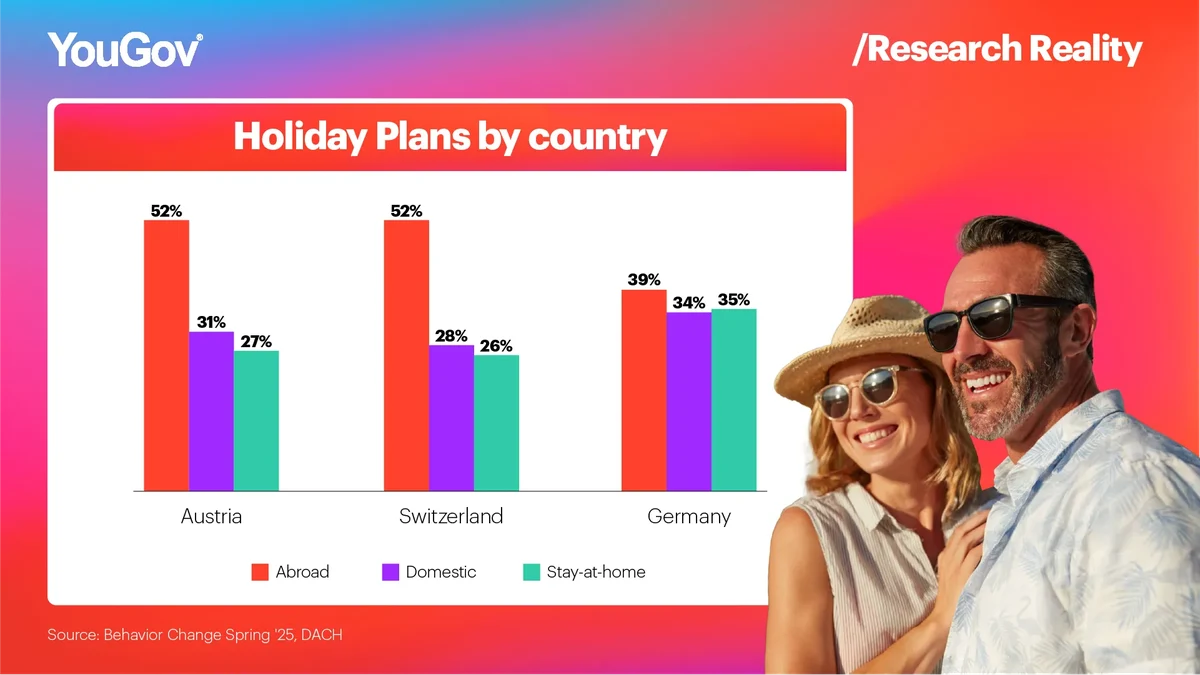

The allure of international travel remains strong, particularly for Austrians and the Swiss. According to the YouGov data, 52% of Austrians and 52% of Swiss are planning holidays abroad. However, Germans show a more tempered approach, with a lower 39% intending to travel internationally.

Conversely, domestic holidays and staycations are a significant part of the picture:

- Holidays in their home country appeal to 31% of Austrians, 28% of Swiss, and a higher 34% of Germans.

- A substantial portion also plans to stay at home for their holidays: 27% in Austria, 26% in Switzerland, and 35% in Germany – the highest among the three.

This data suggests that while the dream of foreign shores is alive, there's a robust market for local tourism and home-centric relaxation across the DACH region, especially in Germany.

The desire to travel remains strong – especially as many consumers still feel the urge to make up for lost time after the pandemic. But today’s holiday planning comes with a twist: while affordable dream destinations like Turkey, Egypt or Southeast Asia continue to appeal, financial concerns are leading many to rediscover the comforts of home or explore nearby alternatives.

Why many DACH consumers are staying put

For those opting out of travel, financial realities are the most significant factor. YouGov’s study shows that "Financial constraints" are the top reason for not taking a holiday:

- Austria: 46% of those staying home cite financial reasons.

- Switzerland: This figure rises to 55%, the highest in the DACH region.

- Germany: 52% point to budget limitations.

Other notable reasons for forgoing holidays include health concerns (AT: 15%, CH: 20%, DE: 22%) and, to a lesser extent, family obligations or simply a lack of interest in traveling at this time. Understanding these core motivations is key for engaging in this consumer segment.

Local flavors preferred, but some essentials make the trip

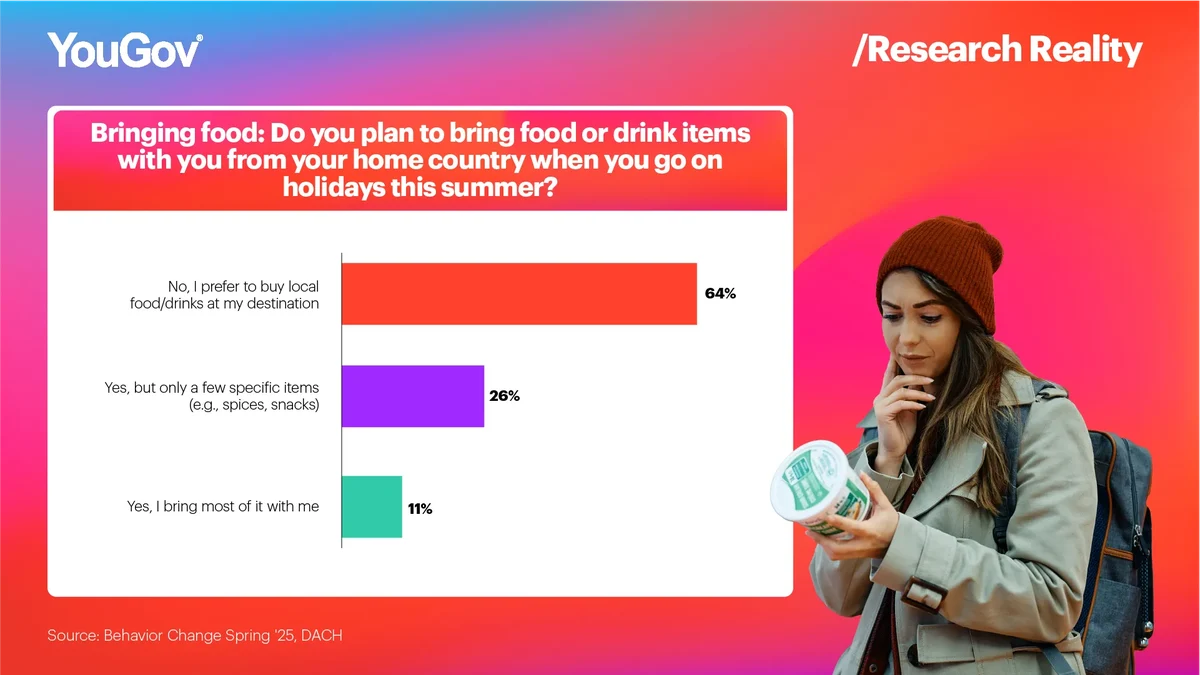

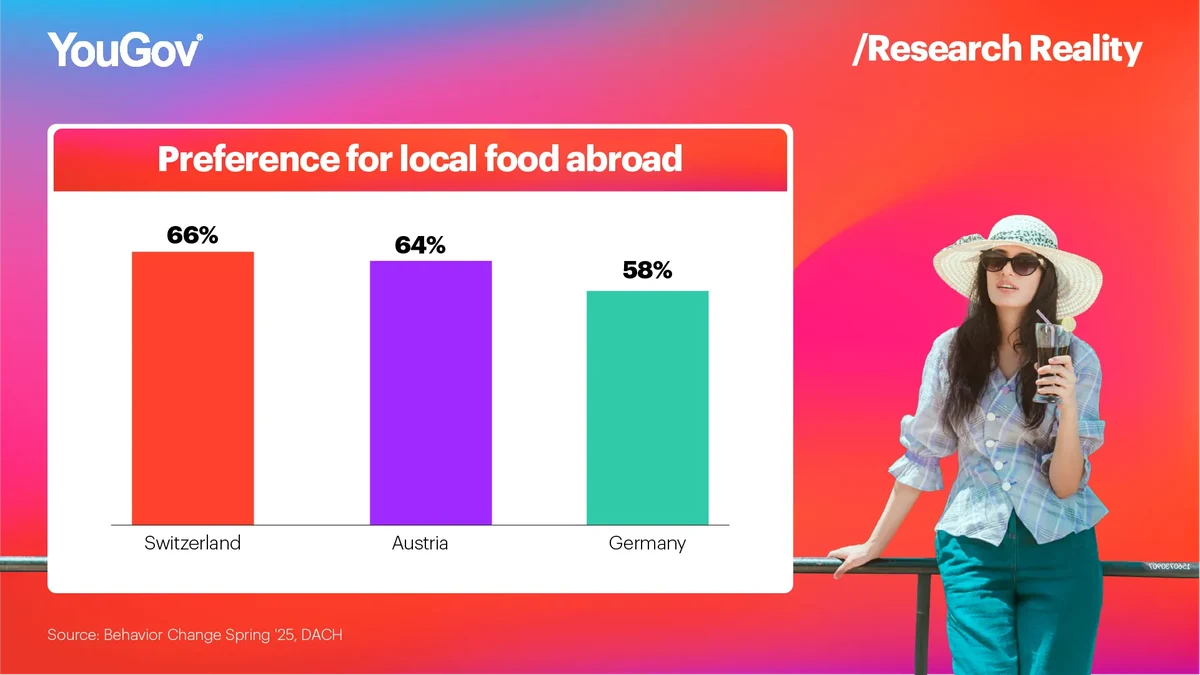

When DACH residents do travel abroad, there’s a strong preference for immersing themselves in the local culinary culture rather than bringing familiar food from home. While 11% say they bring most of their food and 26% take a few specific items like spices or snacks, nearly two-thirds (64%) prefer to buy food and drinks at their destination. This underscores a widespread openness to local flavors — a defining trait of the DACH holiday mindset.

While Germans show a marginally higher tendency to bring certain food items from home, the dominant pattern across the DACH region is a clear preference for consuming local products at the destination — highlighting opportunities for local food and beverage providers.

Crafting the "Holiday Feeling" without leaving

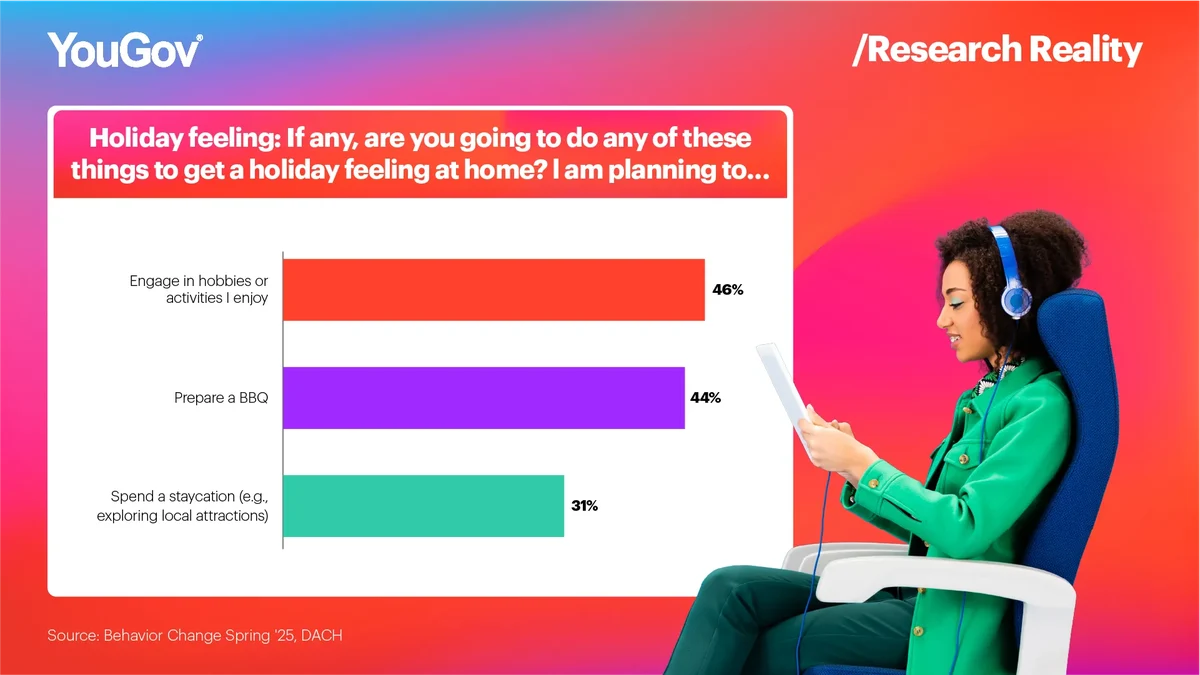

The YouGov data also sheds light on how DACH consumers create a holiday atmosphere even when staying home or opting for a "staycation." Popular activities include:

These figures underscore the importance of the home as a sanctuary for relaxation and enjoyment, the continued appeal of local exploration, and the growing interest in local leisure activities such as BBQ-ing — a trend especially pronounced in the DACH region (44%) compared to, for instance, 31% in the Netherlands and 35% in Poland.

Navigating the evolving DACH holiday landscape

The way Austrians, Swiss, and Germans approach their holidays in 2025 paints a picture of a region balancing aspiration with pragmatism. While the desire for international travel remains, particularly in Austria and Switzerland, economic realities mean a significant number are also exploring domestic destinations or finding joy in staycations and home-based leisure.

Across all three nations, financial constraints are the leading factor for those forgoing travel, underscoring prevailing budget-consciousness. Yet, even when venturing abroad, there's a notable appreciation for local experiences, especially culinary ones. For those staying closer to home, creating a special "holiday feeling" through activities like BBQs, personal hobbies, and enhancing their home environment is a clear priority.

These overarching trends provide a valuable snapshot, but the YouGov Behavior Change study allows for a much more granular understanding of these behaviors.

The strategic advantage for businesses emerges when these preferences are analyzed across diverse consumer segments. For instance, how do holiday choices and spending priorities differ between younger and older generations, varying income brackets, or households with and without children? Understanding these nuances is crucial.