Economic pressures in 2025 continue to influence household budgets across the DACH region, prompting shoppers to reconsider not only what they buy, but also where they choose to shop. Grocery retail remains a core part of these adjustments. While price sensitivity is constant across age groups, the ways in which younger and older consumers navigate this reality reveal important differences for FMCG and retail strategy.

The Behavior Change Report sheds light on how these two groups – younger shoppers and older shoppers – are responding to ongoing challenges, with particular attention to the role of discount channels, attitudes toward supermarkets and hypermarkets, and expectations for in‑store experience.

Channel shifts: Discount as the shared anchor

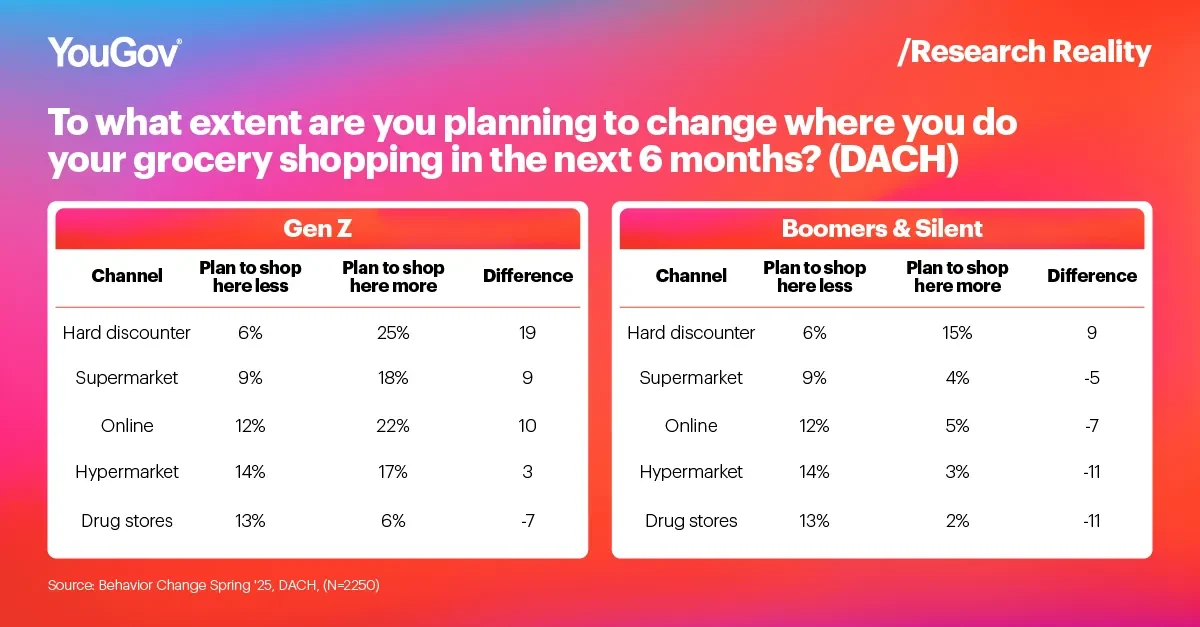

When it comes to adjusting shopping channels, price sensitivity is the common denominator. Both younger and older shoppers show a clear intention to increase purchases at Hard discounters, underlining their central role as the most resilient FMCG format.

Beyond this shared preference, differences appear in how each group views other main FMCG channels. Older shoppers remain cautious, showing limited intention to increase visits to supermarkets or hypermarkets. Their approach is selective and focused, with little change outside of the discount segment.

Younger shoppers, while also anchored in discount channels, show more openness to revisiting supermarkets and hypermarkets after the inflationary period. This is less a signal of budget expansion and more an indication of willingness to reallocate spending where improvements in service and variety justify the choice. The opportunity for these formats lies in maintaining value while enhancing the overall experience to meet evolving expectations.

In‑store experience: Meeting different shopper needs

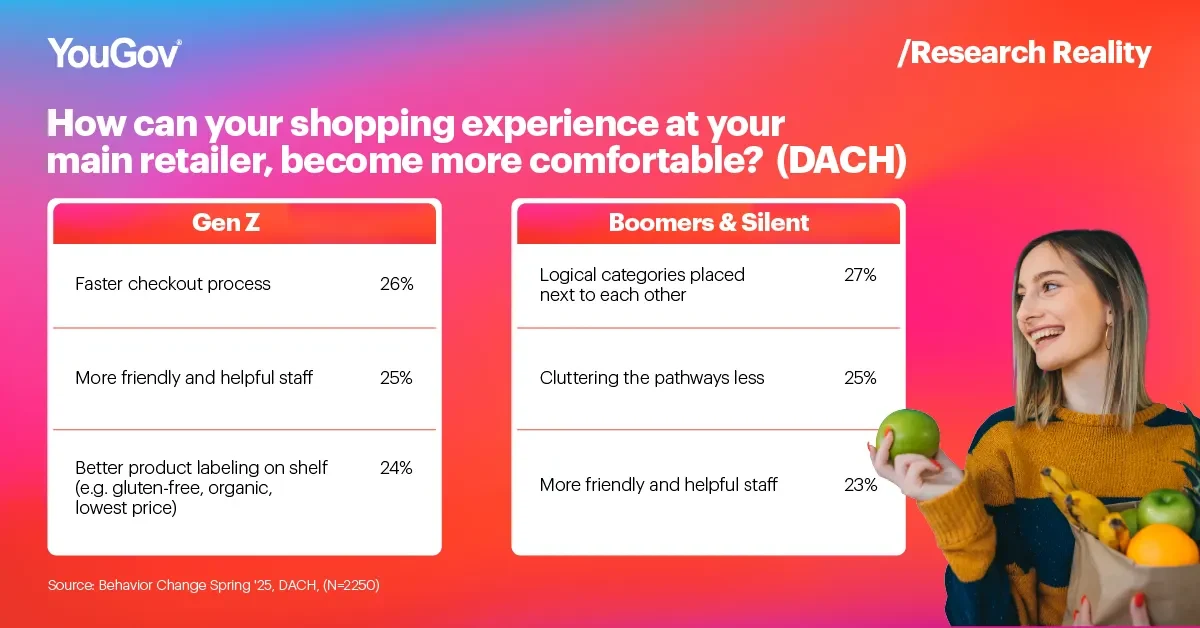

Expectations for in‑store improvements help explain these differences in channel openness. Younger shoppers tend to focus on efficiency: faster checkout processes, clear product signage, and layouts that support a streamlined journey. These factors reduce friction and make supermarkets or hypermarkets a more appealing option alongside discounters.

Older shoppers, in contrast, are more concerned with comfort and predictability. Logical category placement, less cluttered pathways, and the reassurance of a familiar store environment define a positive experience for them.

While technology is increasingly integrated into the retail journey, human interaction remains a shared element of satisfaction – a reminder that operational changes should complement, rather than replace, personal service.

Product engagement: Discovery anchored in familiarity

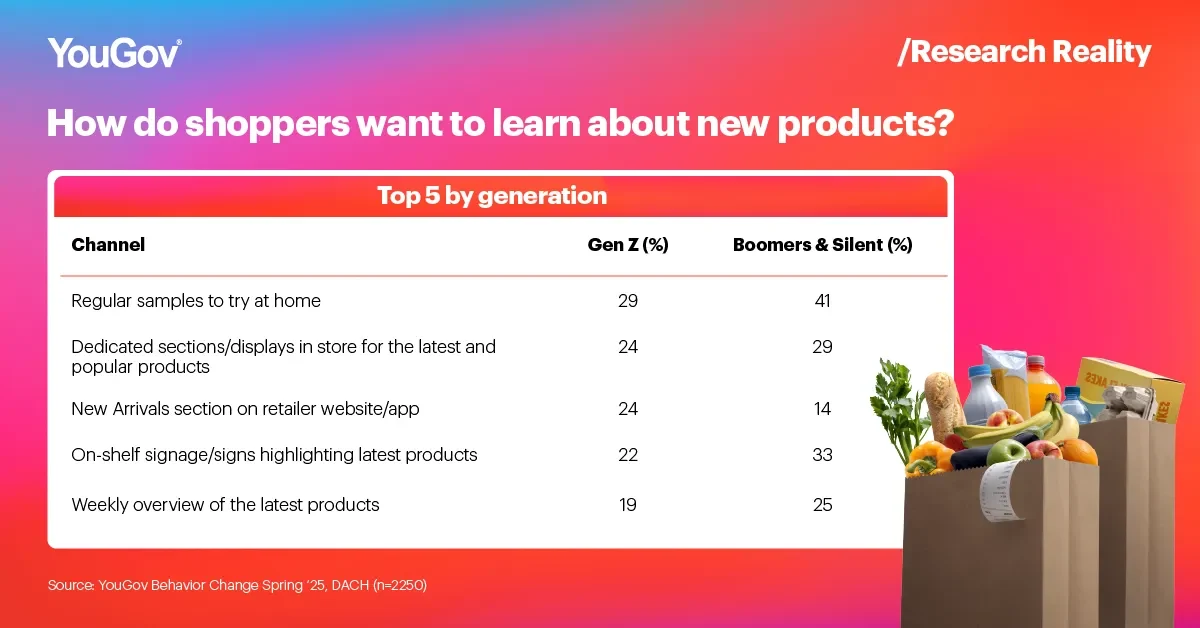

When it comes to discovering new products, there is a point of convergence. Both younger and older shoppers prefer regular samples to try at home, offering retailers a low‑risk way to engage both groups without generation‑specific tactics.

However, assortment expectations vary. Younger shoppers show greater receptiveness to seeing main retailers extend into categories such as cosmetics, sports and outdoor products, and medical supplies. These reflect lifestyle interests that go beyond basic FMCG needs.

Older shoppers are generally more cautious about assortment expansion. Many express no interest in new categories, but those who do tend to favour home and kitchen appliances or gardening products – practical additions aligned with established household routines.

For retailers, the key is to align assortment extensions with each group’s expectations. In both cases, relevance and perceived value determine whether an expanded range will succeed.

Lifestyle aspirations and the role of technology

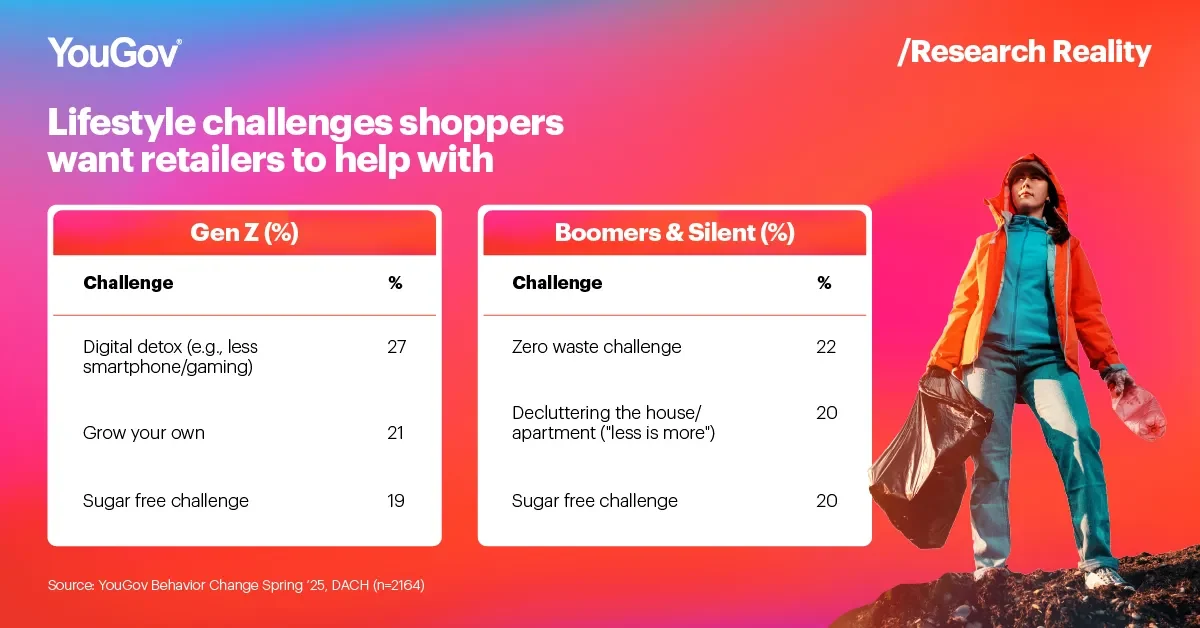

Lifestyle aspirations also shape attitudes towards retail engagement. Both groups list sugar‑free living among their top aspirations, but beyond that, their focus areas diverge. Younger shoppers place greater emphasis on wellness and self‑management, including digital detox and growing their own food. Older shoppers concentrate more on sustainability and practicality, with zero waste and decluttering standing out in their list of preferences.

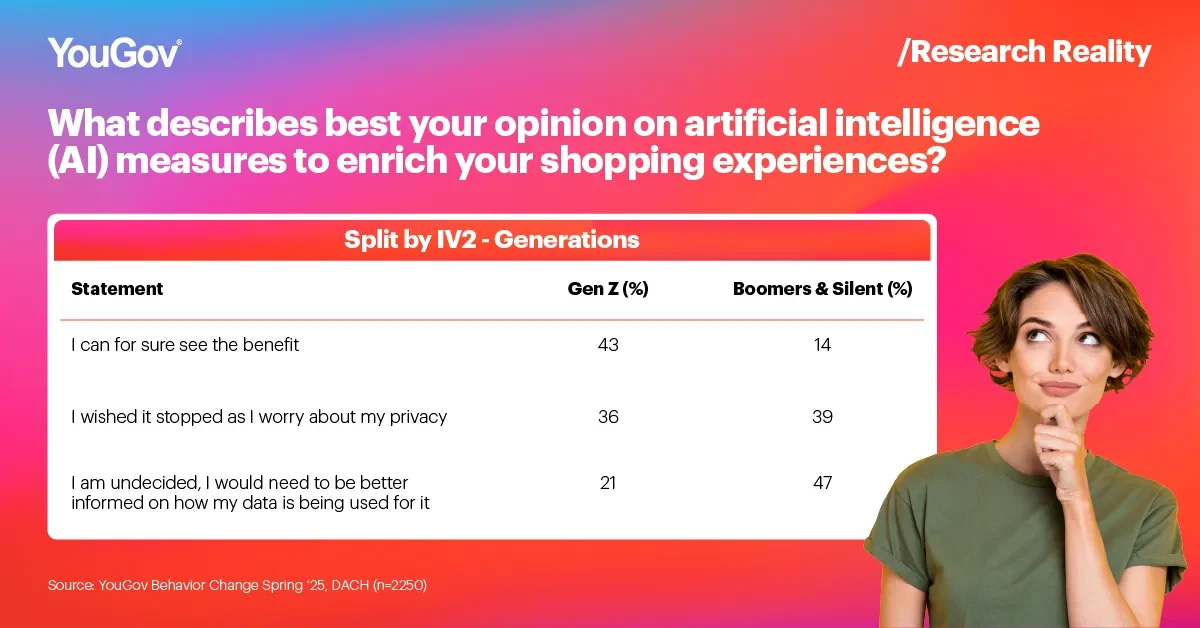

These values also reflect how technology is perceived. Both groups recognise potential benefits from AI in retail, whether in streamlining the shopping process or improving the relevance of offers. Concerns about privacy are present across both generations, but not in a way that creates a generational divide.

The opportunity for retailers lies in aligning technology and service innovation with the specific priorities of each group, ensuring that changes feel supportive rather than intrusive.

Generational differences in shopping behavior are less about opposing needs and more about distinct priorities. Both younger and older shoppers remain highly price‑sensitive, which keeps discount channels at the core of FMCG strategy. The task for retailers is to recognize where service improvements and assortment can reopen the door to mainstream channels for younger shoppers, while also maintaining the reliability and comfort that older shoppers value. Balancing these priorities within a single retail framework is key to sustaining relevance.

The Behavior Change Report highlights a retail environment in which both younger and older shoppers are making careful, value‑driven choices. Hard discounters remain the shared anchor for both groups, reflecting the sustained importance of price.

Where they differ is in openness toward other channels. Younger shoppers are willing to re‑engage with supermarkets and hypermarkets when these formats deliver on service and variety, signaling potential for gradual reallocation of spending. Older shoppers remain more cautious, keeping their focus on trusted channels and predictable in‑store experiences.

For FMCG and retail, these insights underline the importance of adaptability. Success will depend on strategies that respect the shared price sensitivity of all consumers while tailoring store formats, assortments, and service to meet the distinct expectations of each group.