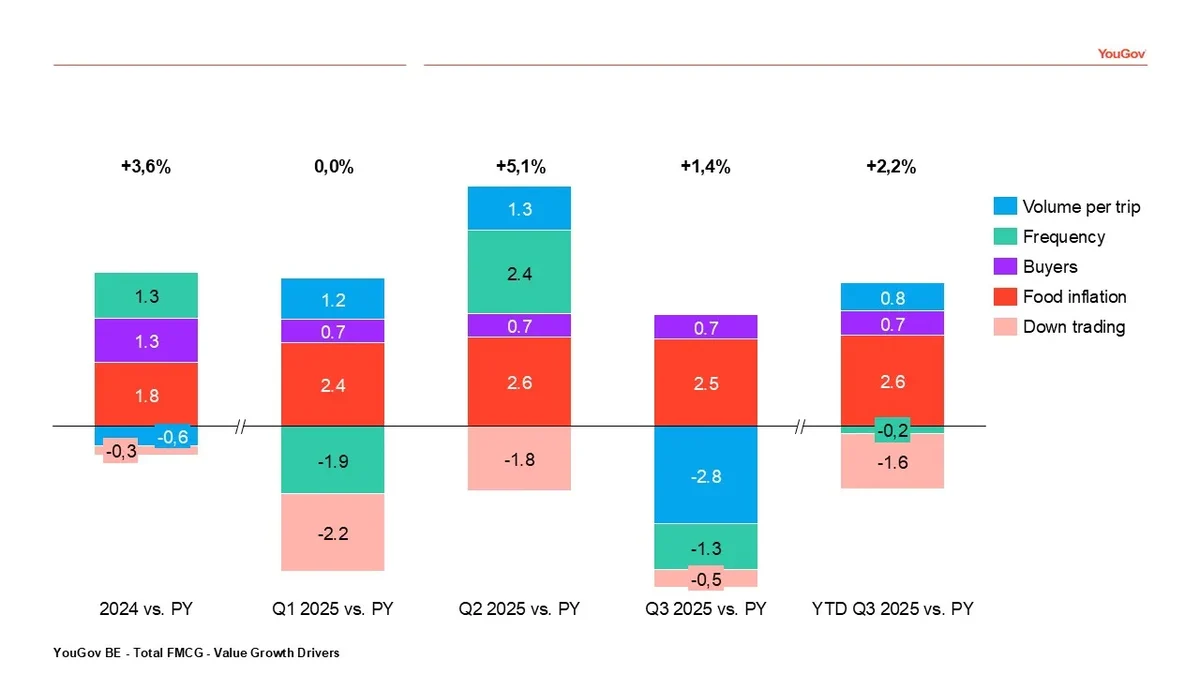

In Q3 2025, Belgian FMCG value growth slowed to +1.4% versus last year, marking a shift from the strong +5.1% seen in Q2. This article discusses the underlying trends behind this evolution.

KPIs

Food inflation remains the dominant growth driver (+2,5%) and it has been stable throughout 2025. Next to food inflation, population growth (+0.7%) contributes modestly to the growing market. However, KPIs volume per trip (-2.8%) and shopping frequency (-1.3%) declined in Q3, reversing the momentum from earlier quarters. Also, downtrading continues to weigh on performance (-0.5%), though its impact is less pronounced than before.

This quarter reflects a more challenging environment, with inflation sustaining value growth but volumes being under pressure.

External Factors

Compared to Q3 2024, August was the weakest month, performing worse than the previous year. Two calendar effects amplified this decline: the month included an extra Sunday, reducing shopping opportunities, and Assumption Day (August 15) fell on a Friday, creating a long weekend that encouraged travel and leisure activities. Combined with the summer holiday period, these factors shifted consumption away from in-home FMCG purchases toward out-of-home spending, further reducing shopping frequency and volume per trip.

Downtrading

Downtrading has been a key theme in 2025. In the first semester it was strongly present, but unlike previous years, this trend was not driven by a shift from A-brands to private labels. Instead, it resulted from intensified promotional activity. In Q3, promotional pressure eased, especially among A-Brands. As a result, downtrading has been less impactful compared to the first part of the year.

Retail Channels

In Q3, Hard Discount emerged as the fastest-growing retail channel, surpassing the 20% market share threshold for the first time. Hard discount directly steals value from all channels, with the exception of E-Commerce. Meanwhile, Hypermarkets, Proximity Stores, and Cross-border Shopping continued their downward trend, each losing market share for consecutive years during Q3.

Looking Forward

We anticipate that Q4 2025 will largely mirror the trends observed in Q3. If shopping frequency recovers, partly driven by more Sunday openings, we could see slightly more positive value growth, potentially around +2–3%.

Two trends to watch for Q4:

- Will Hard Discount continue its strong growth trajectory?

- How will the market evolve in terms of downtrading and promotional pressure?

Stay tuned to find out!