Body weight tops the worry list

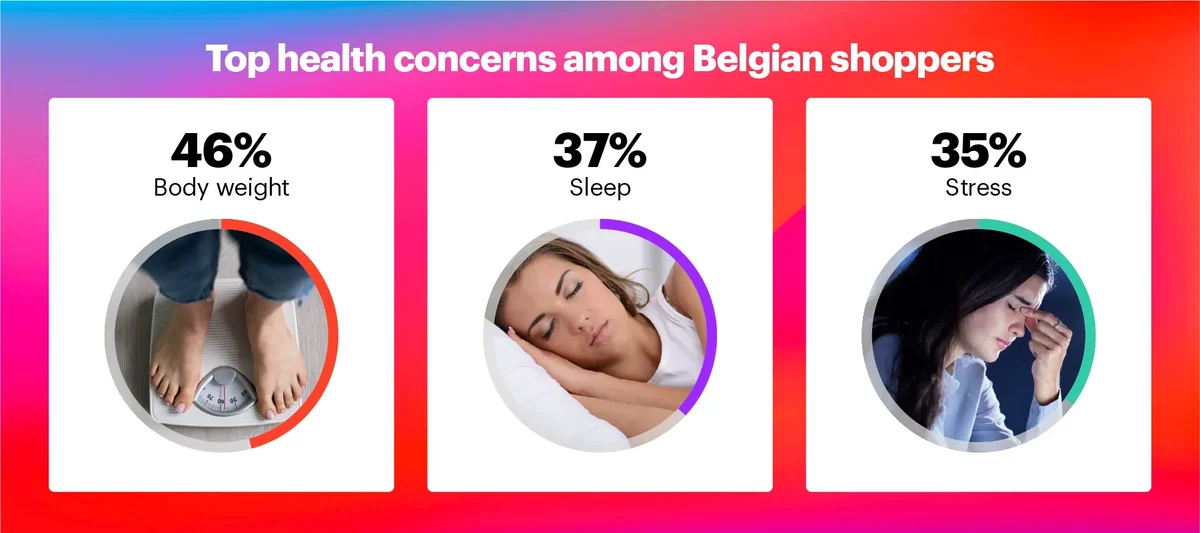

Belgians may seem more relaxed about health than the global average, worrying less about mental well-being, skin and hair care, and chronic conditions. But beneath that calm surface, struggles with mental and physical health are growing (+3% vs. 2024) and when Belgians do worry, their top concerns do align with global trends:

Belgians worry about their body weight, but that doesn’t necessarily translate into real lifestyle changes. Fewer than half exercise regularly, far behind the global average of 61%. Certain eating habits also lag behind: only 46% stick to a regular schedule and just 40% follow a balanced diet. Unsurprisingly, Belgium also counts fewer than one in four “health actives” (consumers who consistently make healthy choices) in 2025.

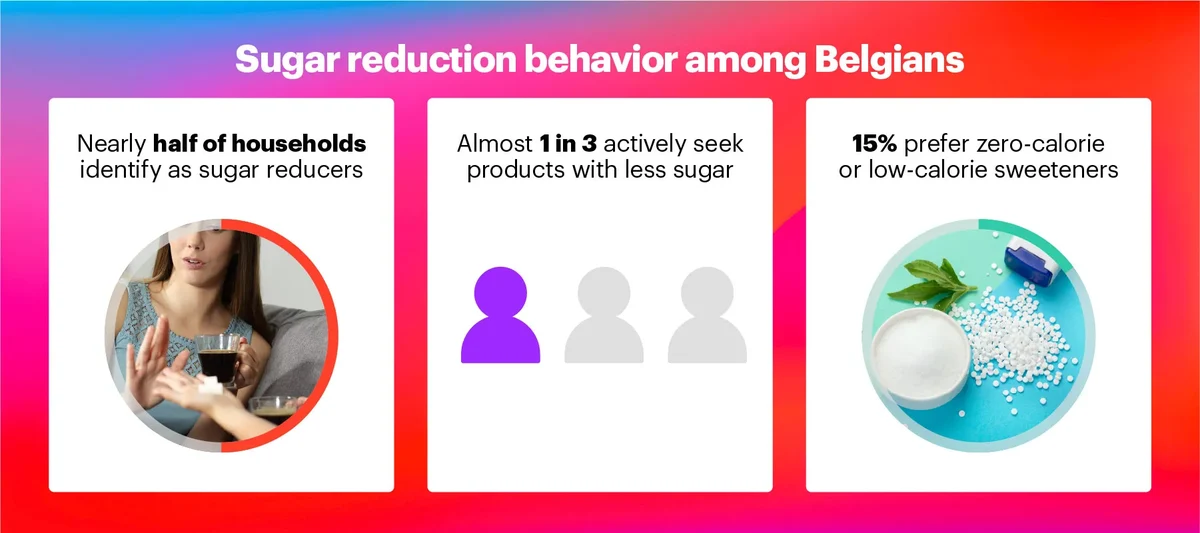

Instead of committing to structural changes, many Belgians opt for symbolic gestures. Sugar reduction is the most popular shortcut:

Actions like cutting back on sweets, choosing “light” drinks, or switching to products with reduced sugar gives a sense of progress without demanding major effort. This trend is fuelled by strong marketing around “low sugar” and “zero” options, and by the perception that sugar is the main culprit for weight gain and energy dips. This sugar avoidance is reinforced by planned consumption cuts: 4 in 10 shoppers intend to reduce chocolate, sweets, and ultra-processed foods. But these efforts often stop at small tweaks rather than full lifestyle shifts opening the door for other perceived “quick wins.”

Beyond sugar, supplements are another possible shortcut, but credibility is mixed. While most health-boosting products face scepticism, some categories still attract notable interest. Immunity-boosting and multivitamin supplements and probiotics show potential, with 4 in 10 shoppers perceiving them as valuable. In contrast, other categories are met with strong resistance: high-protein foods, collagen and CBD products are rejected by over half of shoppers.

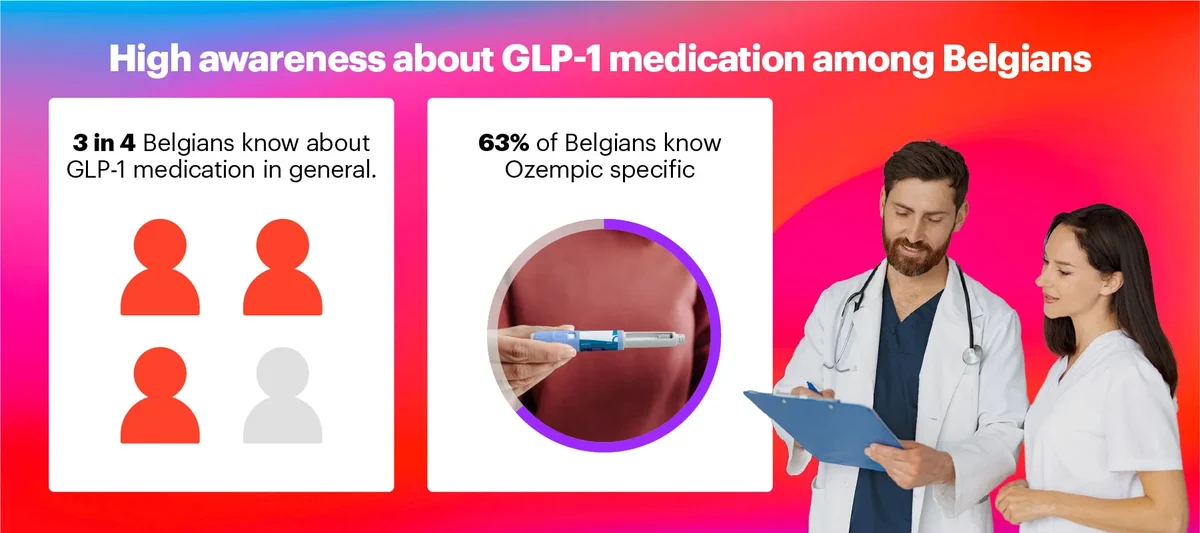

That credibility gap creates fertile ground for pharmaceutical shortcuts. Awareness of GLP-1 medications like Ozempic is strikingly high: three in four Belgians know about them, compared to one in two globally. Adoption remains limited but significant: 6% of households already use GLP-1 treatments and another 7% would consider them. Together, these groups represent €5 billion in FMCG spend, signalling that the promise of rapid weight loss with minimal effort is affecting the health landscape.

What’s your next move?

From weight concerns to small health gestures like sugar reduction and selective supplement use, Belgian shoppers show a preference for easier ways to feel healthier. At the same time, high awareness and early adoption of GLP-1 medications signal that convenience is becoming a key driver in health choices. Understanding who these consumers are and what this means for your category is essential. Download the full Who Cares? Who Does? Health 2025 report or watch our on-demand webinar to explore the insights and opportunities.