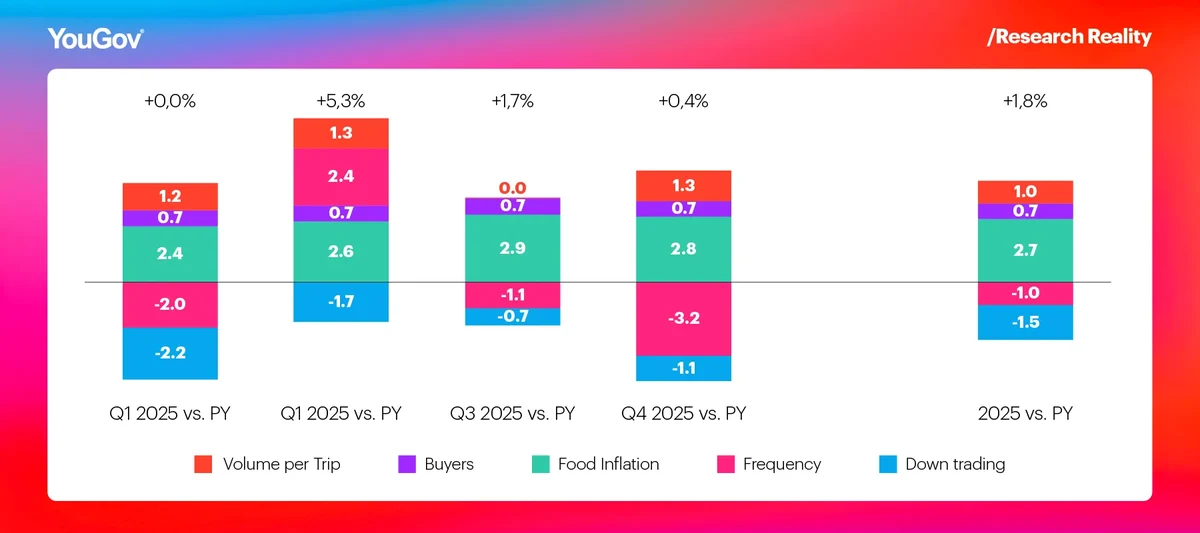

In the final quarter of 2025, the Belgian FMCG market stabilized, recording a modest value growth of 0,4% compared to last year. On a yearly basis, the market achieved a stronger 1,8% growth, largely driven by the exceptionally strong performance in the second quarter.

This article discusses the underlying trends behind this situation.

KPIs

Food inflation remains the primary driver of growth (+2,8%) and has stayed relatively stable throughout 2025. Households continue to seek cheaper options. On a yearly basis, downtrading (-1,5%), alongside food inflation, stands out as a key driver. It puts downward pressure on overall value growth.

Overall, both the quarter and the full year reflect a challenging market environment, where inflation supports value growth while volume remains stable.

External Factors

Sunday openings were a major theme in 2025. However, despite this additional shopping opportunity, shopping frequency did not get the expected boost. In fact, frequency even showed a slight decline.

Promotional Pressure

A key theme in Q4 was the intensifying promotional pressure. In particular, November stood out with Albert Heijn’s extreme 2+5 promotion, quickly followed by similar actions from Colruyt LP. At the same time, we observe A-Brands gaining volume share while private label open market loses. Combined with ongoing downtrading, these shifts could indicate that households increasingly rely on promotions to cope with rising food inflation.

Retail Channels

As anticipated in the previous newsletter, Hard Discount continued its value growth in the last quarter of the year, increasing by 0,4pp compared to the same quarter of 2024. Although E-commerce grew in terms of absolute value, its share remains stable within the growing FMCG market.

Looking Forward

Looking ahead, several key questions will shape the market’s evolution. One of the most pressing is if the ongoing decline in purchase frequency will turn into a lasting trend. At the same time, it remains to be seen whether Hard Discount will sustain its current growth trend. A final consideration is the ability of Private Label to reverse their recent volume share loss.

Stay tuned to find out!