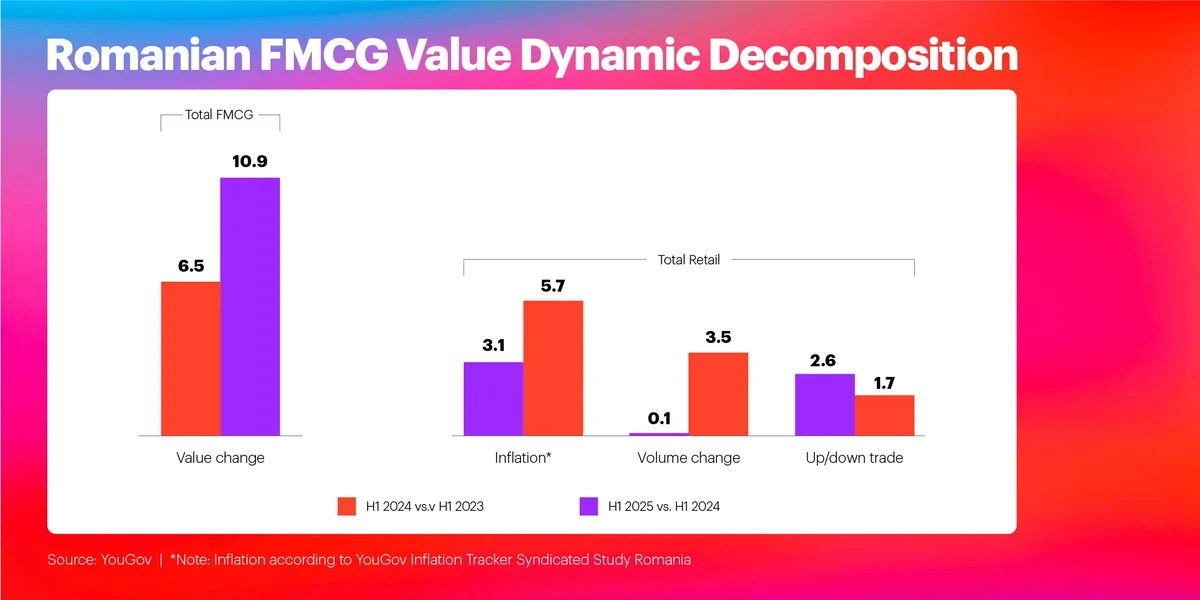

Political turmoil, recession risk, a high level of inflation and increasing bank financing costs for the Romanian population – all these circumstances have hurt real incomes and consumer confidence in the first semester of 2025, but they are not yet strongly impacting local FMCG sector. YouGov Shopper data shows a balanced market growth in January-June 2025, compared to the first half of the previous year.

Approximately half of the 11% growth was driven by inflation, while the other half was a combination of volume increase (+3.5%) and the "up-trading" phenomenon where consumers opted for more expensive and higher-quality products. There was also a slight recovery in purchasing frequency, which had declined in the previous year.

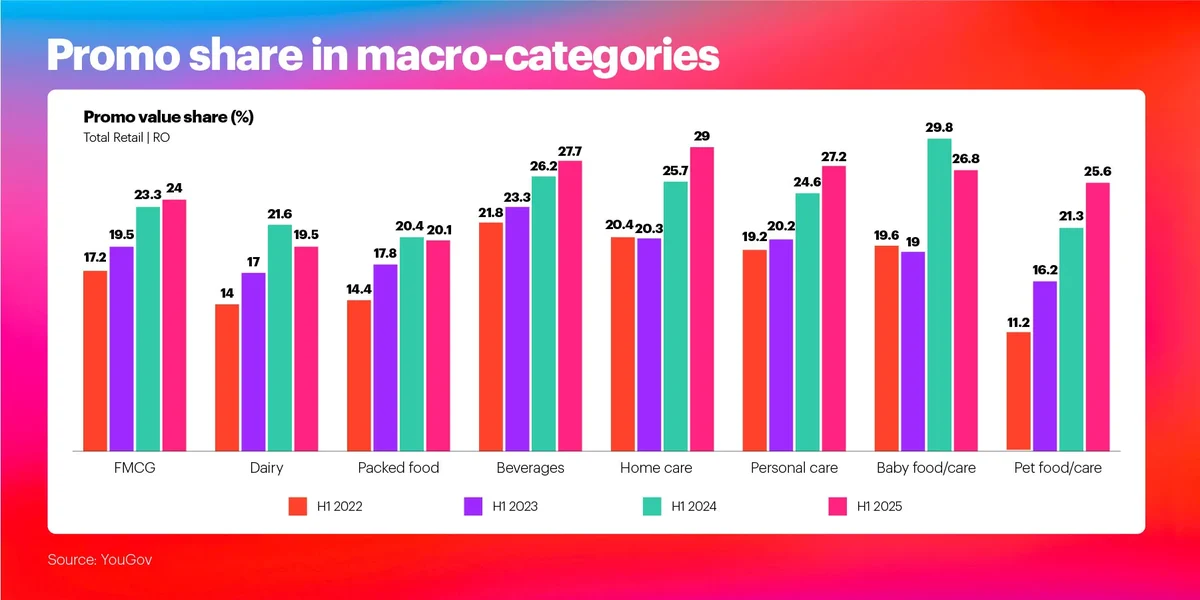

Promotions: a key, yet decelerating driver

Promotions attracted more attention in H1 2025, with cherry-picking shopping missions slightly increasing compared to previous year. Growth in large stock-up baskets may also reflect customers’ promo-hunting behavior. Cherry-picking refers to the behavior of a shopper who goes from store to store, buying mostly the items that are on sale or specially priced.

YouGov Shopper data reveals that promo increased importance in categories such as beer, wine, sweets, pet food, and cleaning products. At the other side, categories like dairy, oil, coffee, and frozen foods show a declining promo share in H1 ’25 vs. PY.

As for the retail channels, promo intensity got even higher in online stores, supermarkets, and traditional trade. However, at Total Country level, promo development has slowed down this year.

Promotions and PL, still with divergent trends

As opposed to Branded segment, Private Labels registered a share decline in Jan-Jun 2025 compared to H1 ‘24, at Total FMCG level. Having a big stake in the promotional strategy, the brands strengthened their position in the market, at the expense of Private Labels. Producers’ Brands currently account for three-quarters of the total household’s spendings on FMCG.

Retail channels analysis shows the consumption polarization: in Branded segment in Hypermarkets and Supermarkets, both Premium and Economy products have gained importance in the first half of 2025, compared to January-June last year. At the same time, Private Labels have lost ground on both price tiers. In Discounters, growth was led by Economy Brands and Premium Private Labels.

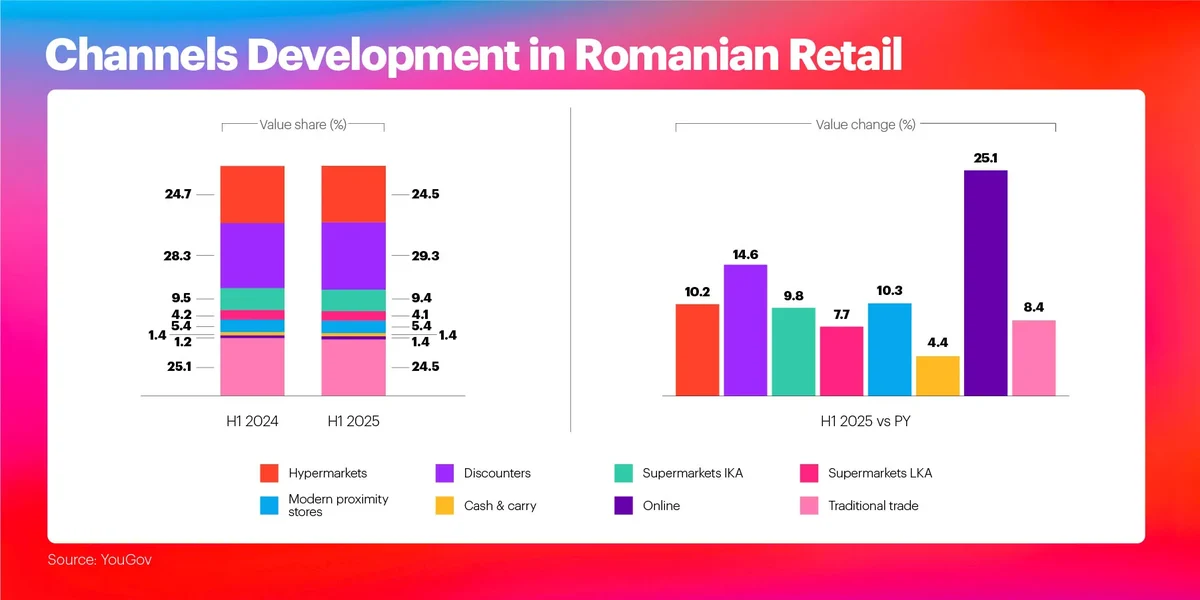

While spend per tip increase was the common denominator for the channels value development, in the inflationary context, just a few of them won from increasing number of shopping occasions (which drives loyalty): Discounters, Modern Proximity Stores and Online Shops. On the other side, households made fewer trips in Hypermarkets, Supermarkets and Traditional Trade. Hypermarkets strengthened their position only in medium-sized cities and small urban, while the channel lost over 1.9pp val. share in Bucharest & Ilfov.

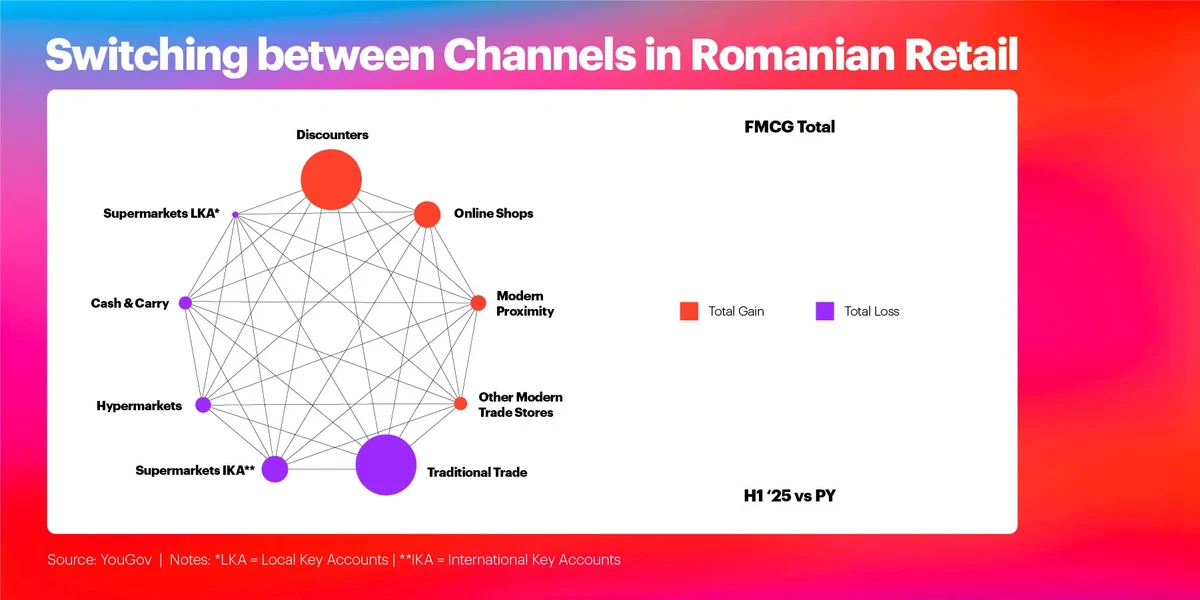

Consumers were rapidly migrating from one retailer to another

Retailer switching analysis shows that Discounters are the big winners in H1 ‘25: they were outsourcing turnover from all the other channels. On the other side, Hypermarkets lost important value especially towards Supermarkets, Discounters and Online Stores, although they struggle to remain relevant as a one-stop-shop for the Romanian households.

Discount channel is rapidly approaching 30% market share threshold, while at the opposite end, Traditional Retail has fallen below 25% threshold. Auchan Group entry in Discounter segment with ATAC brought a few extra percentage points to the channel value growth, which continues to “steal” market share from other retail formats - especially from Traditional Trade, Hypermarkets and Supermarkets.

FMCG Online Stores remain the retail star in 2025, with a 25% increase rate in the first semester, compared to Jan-Jun. 2024. Moreover, this emerging channel was developing on all drivers (penetration, purchase frequency and average shopping basket), reaching 1,4% value share.

Shopping basket decomposition

Fresh Food value share in Romanian households’ basket decreased, but it remains above 30% (the highest share), while Dairy currently covers 11% of the total FMCG expenditures.

From all macro-categories, Baby Food & Baby Care showed the strongest value growth in the first semester (+23.8%), driven by penetration increase. Except Pet Food – with a performance boosted by higher shopping frequency – all the other macro-categories were gaining value in-store due to spend per trip increase, in the inflationary context.

There were some basic food categories declining at a high rate in volume in-home, in the first semester of the year vs. H1 ‘24: salt, seasonings, bouillons, sugar (while the healthier alternative, honey, posted + 24%). On the other hand, households are opting more for convenience food & desserts (frozen vegetable dishes, frozen pastries & desserts, canned prepared food were in top volume growth rates).

The impact of the austerity measures is yet to come

In conclusion, the Fast-Moving Consumer Goods (FMCG) sector has shown resilience so far, but the biggest pressure on Romanian households budgets will be felt in the second half of the year. Starting in August 2025, the VAT increase and higher excise taxes on diesel, gasoline, tobacco, alcoholic beverages, and non-alcoholic beverages with added sugar will come into effect. In addition, the over-taxation of pensions will be introduced, and there will be new measures aimed at reducing public sector wages.

Methodology: YouGov Shopper Romania is based on continuously collected data and rolling surveys on 6,000 households representative for the total population of the country.

YouGov Shopper offers access to a wealth of expertise and quality consumer panel data. We help the world’s most recognized FMCG & Retail brands to deliver superior customer experiences at every stage of the shopper journey. Learn more about YouGov Shopper.