GLP-1 medications such as Ozempic, Wegovy, and Mounjaro were originally developed for people living with type-2 diabetes. By regulating blood glucose and slowing digestion, they reduce appetite and help people manage weight more effectively.

In recent years, these treatments have moved from clinical settings into mainstream awareness. In Germany, where safety, structure, and control are widely held values, GLP-1 medications are accelerating a broader shift toward more intentional consumption. Recent YouGov studies, Trend Reality and Who Cares? Who Does?, reveal their influence is beginning to surface in everyday food choices across the FMCG landscape.

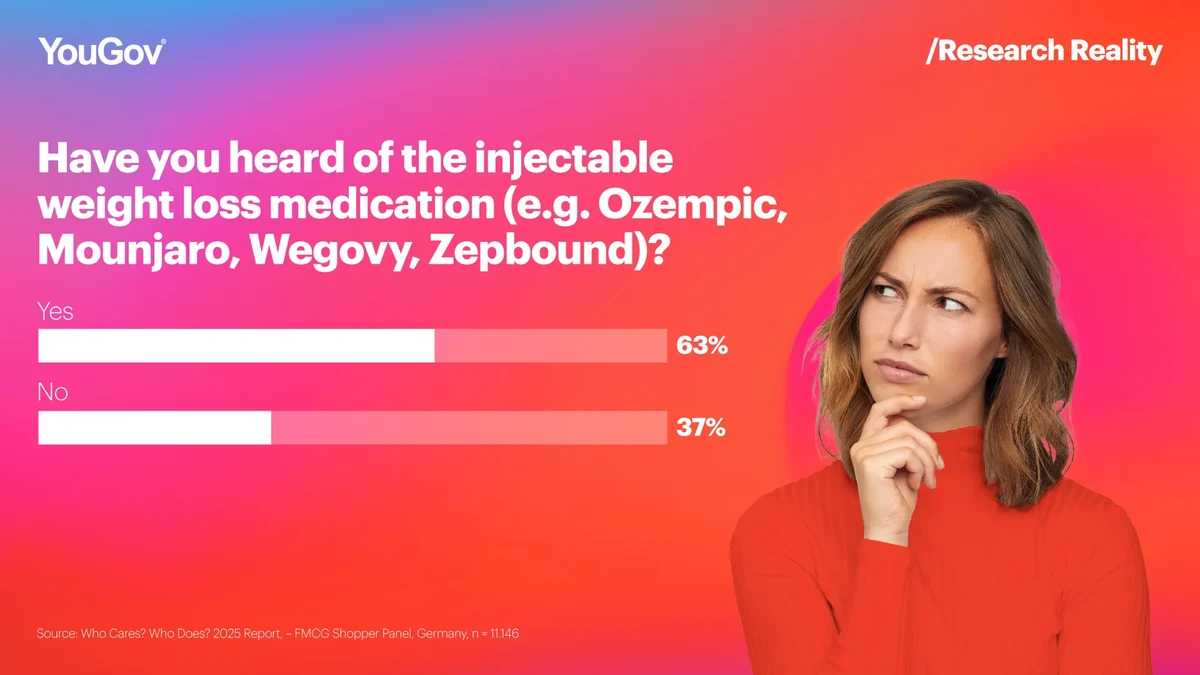

Awareness is high, and adoption is emerging at scale

63% of German adults are already aware of GLP-1 weight-loss injections. And today, over 4 million households either use or are considering using these medications – marking significant early-stage adoption base in a market where:

- 25% of adults live with obesity, and

- 67% of adult males and 53% of adult females are overweight

(Source: die Deutsche Adipositas-Gesellschaft e.V., 2025)

This context explains why medical weight-management solutions have the potential to reshape behavior at population level. What appears to be a new trend is more accurately the next chapter in a long-running desire for self-optimization and control.

Control, convenience, consequence: how GLP-1 is reshaping eating and shopping

As GLP-1 medications slow digestion and increase satiety, users naturally rebalance how they buy and consume food and drinks, boosting the need for:

- Portion-controlled formats that support structure and predictability

- Nutrient-dense, functional products that “work harder” per serving

- Routine-friendly, practical choices over novelty or impulse

- Personal care products that support healthy, feel-good transformation

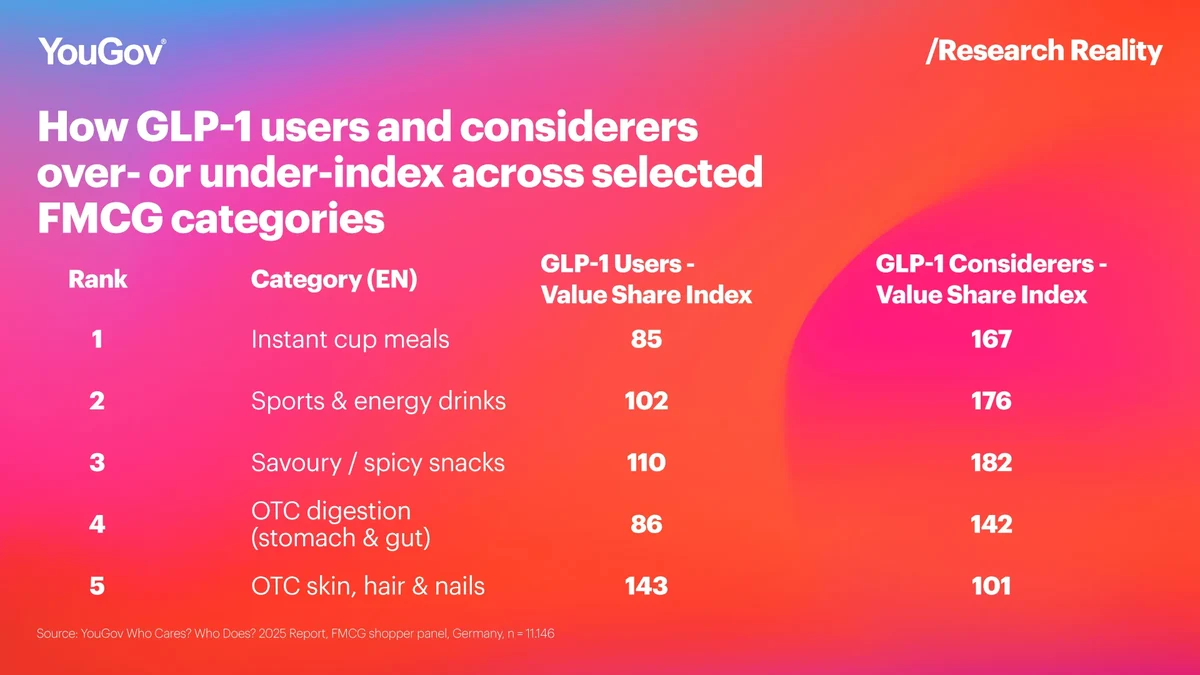

Data from YouGov’s German FMCG shopper panel (2025) shows early signals of basket adaptations between GLP-1 users, considerers, and the general population.

The differences between GLP-1 users and considerers extend beyond food and drink categories. While considerers tend to over-index in more convenience- and impulse-driven FMCG categories like instant cup meals, the pattern in OTC highlights a broader set of health-related needs. GLP-1 considerers over-index in digestion-related OTC products and show higher average spend, whereas GLP-1 users are more strongly represented in skin, hair and nails supplements, where their average spend is higher.

This suggests that GLP-1 related behaviour is not limited to diet alone but may also be reflected in adjacent areas such as digestive health, skincare, and body-related topics, including muscle-related considerations. In the course of 2026, these effects will likely manifest stronger as usage is expanding beyond the realm of diabetes.

What this means for FMCG and Retail

The rise of GLP-1 in Germany reinforces prevailing cultural values: discipline, balance, and evidence-based self-management. It illustrates how medical interventions can cascade into food behaviors, basket composition, and category performance.

Three actions for FMCG and retail leaders:

- Design for portions and purposes

Lean into smaller, controlled formats and products that deliver clear functional benefit.

- Communicate with clarity

Consumers value credibility and transparency. Link aspiration to proof and simplify decision-making.

- Enable self-management

Develop products and services that support structured eating: portion awareness, nutrient-dense choices, and predictable routines.

Injectable weight-loss medications show how physical change becomes behavioral change – a shift defined by control, balance, and everyday practicality. The opportunity for brands lies beyond the hype: in understanding the real adjustments taking place in German households and designing around them.

Sources

YouGov Trend Reality 2025 Report – Germany

YouGov Who Cares? Who Does? 2025 Report – German FMCG shopper panel (n = 11.146)

Die Deutsche Adipositas-Gesellschaft e.V., 2025